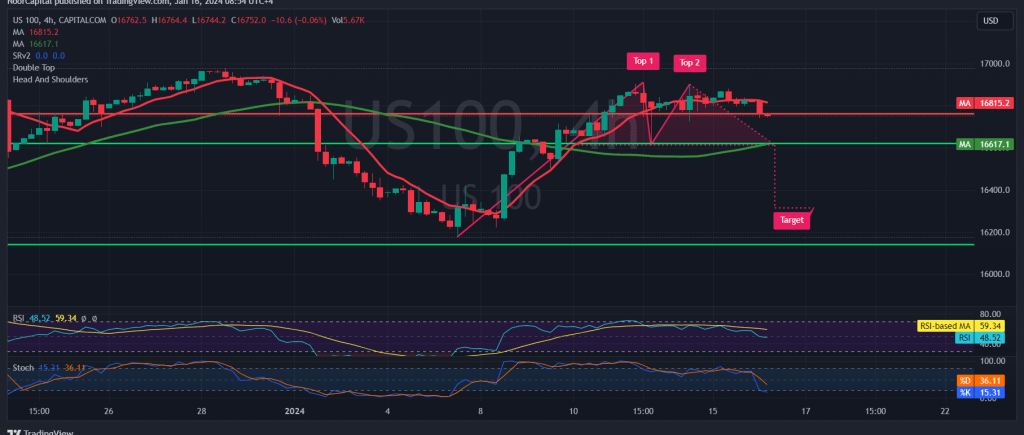

A downward trend has taken control of the movements of the Nasdaq index after colliding with the resistance level of 16,880. This resistance forced the index to trade negatively, with intraday movements stabilizing around 16,750.

From a technical standpoint today, there’s a temporary inclination towards negativity, based on the negative pressure from the simple moving averages continuing to bear down on the price from above. Additionally, negative signals from the 14-day momentum indicator add to the bearish outlook.

The possibility of a downward trend persisting during the coming hours remains valid, with the initial target set at 16,700. Breaking this level would increase and accelerate the strength of the downward trend, with the next target at 16,650 before any potential attempt at a recovery.

It’s crucial to watch for any signs of stability and price consolidation above 16,840, as this would signal a potential return to the official upward trajectory, with targets at 16,930 and 16,980.

Note: Today, high-impact economic data is expected from the American economy, specifically the “New York State Manufacturing Index.” Additionally, from the Canadian economy, “Canadian inflation data” is anticipated, and there’s also expectation regarding “the change in unemployment benefits and the speech of the Governor of the Bank of England” from the United Kingdom. This could lead to high fluctuation in prices during the release of this news. Furthermore, the ongoing geopolitical tensions contribute to the overall high level of risk.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations