The Dow Jones Industrial Average extended its descent on the New York Stock Exchange in the latest trading session, reaching the initial target set at the price of 37330 and marking its lowest point at 37315.

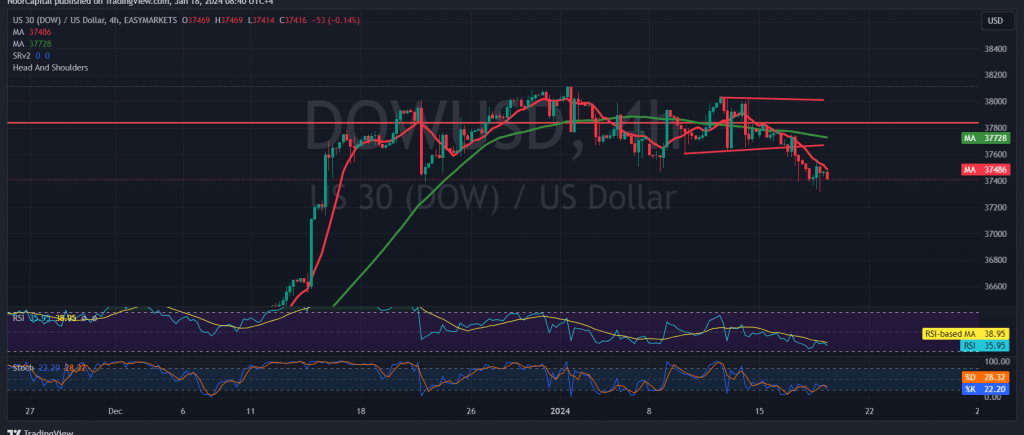

In terms of technical analysis today, upon closer examination of the 4-hour chart, the simple moving averages persist in exerting downward pressure on the price, coupled with the Stochastic indicator positioned in the oversold areas.

Given this context, as long as intraday trading remains below the resistance level of 37545, the bearish scenario remains the most probable for the day. The primary target stands at 37330, with a potential increase in momentum upon breaking this level, propelling the descent towards the second target outlined in the preceding report at the price of 37185.

It’s essential to note that the consolidation of prices above 37545 has the potential to thwart the provisional decline scenario. Instead, it may pave the way for the index to retrace to the official upward trajectory, targeting levels starting at 37675 and 37790.

Warning: The risk level is high amid ongoing geopolitical tensions, and heightened price volatility may be witnessed.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations