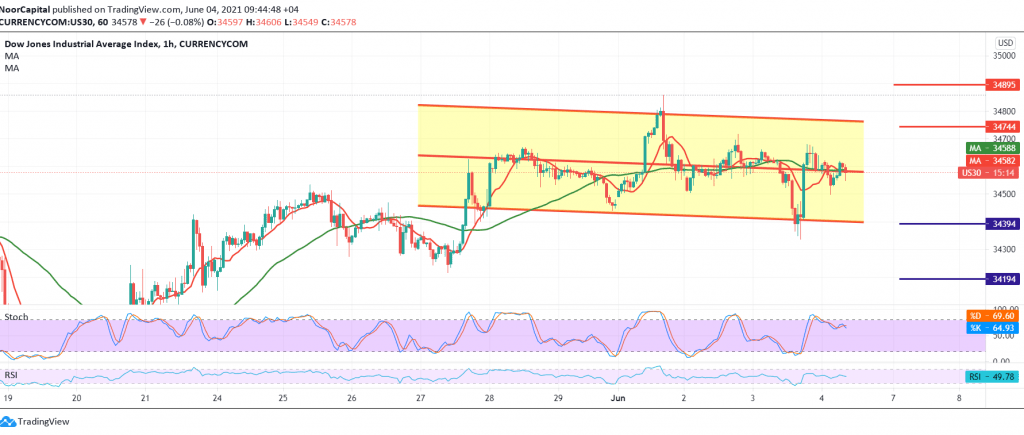

The Dow Jones Industrial Average declined on Wall Street yesterday, nullifying the positive outlook as we expected. We indicated during the previous analysis that activating the bullish scenario depends mainly on the stability of trading above 34,500, and breaking the mentioned level puts the index under negative pressure, targeting 34,420/34,410 initially, and it may extend later towards 34,320 to record its lowest level at 34,312, compensating for the losses of the long position.

On the technical side, the index’s trading bounced again, benefiting from the support floor of 34,320, and by looking at the 60-minute chart, we find the index hovering around the 50-day moving average, waiting for a new signal, and we also find that the RSI started sending warning signals.

Therefore, we prefer to remain neutral for the moment, in order to obtain a high-quality deal, Waiting for one of the following scenarios:

Activating long positions requires that we witness a clear and strong breach of the resistance level 34,660, and that may enhance the chances of rising towards 34,720, taking into consideration that the breach up to the resistance level 34,720 extends the index’s gains towards 34,850.

Activating short positions requires breaking 34,370 to target 34,220, and then 34,170. Note: The level of risk is high.

| S1: 34370 | R1: 34720 |

| S2: 34170 | R2: 34850 |

| S3: 34030 | R3: 35050 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations