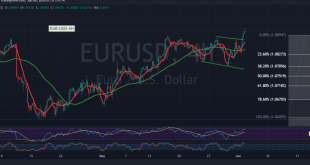

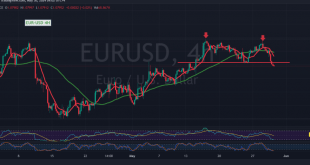

The EUR/USD pair has experienced a notable surge in the early trading sessions this week, breaching the key psychological resistance level of 1.0900 and reaching a high of 1.0915. Technical analysis indicates a potential shift in momentum towards the upside. On the 4-hour chart, the simple moving averages have crossed …

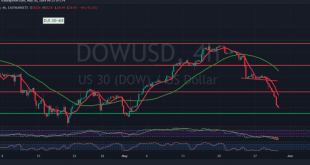

Read More »Dow Jones Faces Further Downward Pressure Amid Bearish Signals 30/5/2024

Oil, Crude, trading

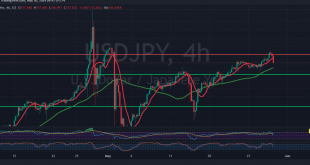

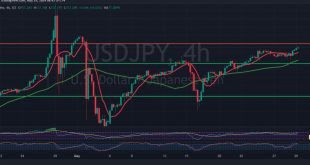

Read More »USD/JPY Maintains Bullish Momentum, but Caution is Advised 30/5/2024

japanese-yen

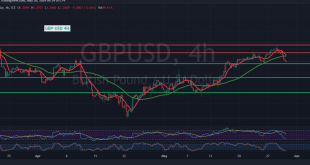

Read More »GBP/USD Shows Signs of Weakness, But Bullish Reversal Still Possible 30/5/2024

Oil, Crude, trading

Read More »WTI Crude Oil Prices Face Potential Correction 30/5/2024

WTI crude oil experienced mixed trading yesterday, oscillating between gains and losses while approaching the previously identified target of 80.75. The commodity reached an intraday high of $80.60 per barrel before encountering resistance. Technical analysis reveals a shift in momentum. The price failed to sustain above the $80.00 level and …

Read More »Gold Prices Face Downward Pressure 30/5/2024

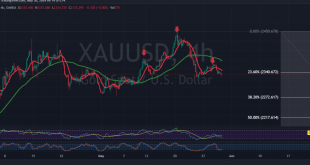

Gold prices have reversed their previously expected upward trajectory, breaking below the critical 2340 support level as outlined in the previous technical report. This development has initiated a bearish turn in the market, with prices currently trading below the 23.60% Fibonacci retracement level on the 4-hour timeframe chart. Further technical …

Read More »EUR/USD Faces Renewed Downward Pressure 30/5/2024

The EUR/USD pair has breached a critical support level at 1.0810, as previously highlighted in our technical analysis. This breach has triggered a wave of selling pressure, driving the pair down to a new low of 1.0790 in early trading. Examining the 4-hour chart, we observe that the euro has …

Read More »Dow Jones extends losses 29/5/2024

Oil, Crude, trading

Read More »Oil is making notable gains 29/5/2024

WTI Crude Oil Prices Set for Further Gains, but Caution Advised WTI crude oil futures prices are on a clear upward trajectory, having recently surpassed the targeted levels of 79.30 and 79.70 and approaching the key psychological level of 80.50. The commodity reached an intraday high of $80.28 per barrel, …

Read More »USD/JPY are recovering 29/5/2024

japanese-yen

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations