The German DAX index hit the vital supply area published during the previous analysis, at 16,290. We indicated during the last analysis that its breach is a condition of obtaining more rise. Today’s technical aspect indicates the possibility of continuing the daily bearish trend. Still, with a closer look at …

Read More »Dow Jones is Looking For Confirmation

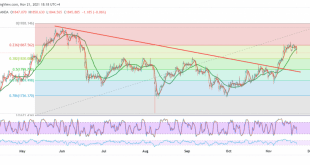

Oil, Crude, trading

Read More »GBP/JPY: Achieves Positive Goals

GBP/JPY succeeded in achieving the first ascending target at the price of 154.50, which must be touched, during the report issued last Friday, recording the highest price of 154.47. Technically, we tend to a positive trading session, relying on the positive motive of the 50-day moving average, which continues to …

Read More »The Canadian Dollar Resumes The Bullish Attack

Noticeable positive trades dominated the US dollar against the Canadian dollar within the idea of the expected bullish correction during all reports of the past week, benefiting from establishing a solid support floor around 1.2500, recording the highest level at 1.2662. Technically, the price has consolidated above the support level …

Read More »Sterling Retesting Resistance

Oil, Crude, trading

Read More »Oil Touches The Target

Oil, Crude, trading

Read More »Gold Showing Signs of Weakness

We adhered to intraday neutrality during the previous analysis due to the conflicting technical signals, explaining that activating the short positions depends on breaking the 1854 level to target 1835. Gold prices posted the lowest level at the end of last week at 1843. Technically, there is a possibility of …

Read More »The Euro Continues Towards Bearish Targets

The European single currency ended its weekly trading in the red areas within the expected negative outlook with the movements within the current descending wave, touching the first price target area for the last analysis at 1.1265, recording its lowest level at 1.1250. Technically, by looking at the 4-hour chart, …

Read More »Dax Touches Our Rising Goals

The German DAX index achieved our first bullish target published during the previous technical report at 16,290, recording its highest level at 16,286. On the technical side, the intraday movements of the index settled above 16,200, accompanied by clear positive signs on the RSI, in addition to the 50-day moving …

Read More »The Dow Jones is Trying to Catch Breath

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations