Oil, Crude, trading

Read More »Oil is under negative pressure 22/5/2023

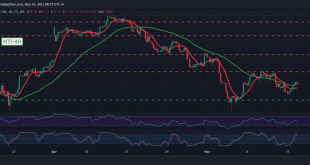

Mixed movements dominated the prices of US crude oil futures contracts at the end of last week’s trading, to start with negativity again after recording its highest price, $73.55 per barrel. Technically, we tend to be negative in our trading, relying on the stability of intraday trading below the resistance …

Read More »Gold is looking for a stronger trend 22/5/2023

Gold prices ended last week’s trading sessions with a noticeable increase, after several successive sessions of the aforementioned corrective decline, to record its lowest level at $1954 per ounce, to start an upward rebound as a result of the US dollar’s decline after Jerome Powell’s statements regarding interest rates. Technically, …

Read More »Euro is trying to take advantage of the support 22/5/2023

The euro-dollar pair ended its weekly trading last Friday with a limited rise, taking advantage of the US dollar’s decline and the pair’s consolidation above the support level of 1.0760. On the technical side today, the current movements of the Euro-dollar are witnessing stability around the top of 1.0830. With …

Read More »Dow Jones may witness a temporary decline 16/5/2023

Oil, Crude, trading

Read More »CAD looking for extra momentum 16/5/2023

The Canadian dollar rose marginally yesterday but failed to maintain its gains above the resistance level of the psychological barrier 1.3500, as the current movements witness stability below it. Technically, we find the 50-day simple moving average trying to push the price to the upside, and we find the RSI …

Read More »GBP advancing against USD 16/5/2023

Oil, Crude, trading

Read More »Oil around overbought 16/5/2023

Positive attempts dominated the prices of US crude oil futures contracts, trying to compensate for its recent losses, recording its highest level during yesterday’s trading session, around $71.74 per barrel. Technically, we tend to be negative in our trading, relying on the negative intersection signs of the stochastic indicator, which …

Read More »Gold is facing selling pressure 16/5/2023

Gold prices did not show significant movements at the beginning of this week’s trading, within sideways movements that tended to be negative and stable in an intraday manner below the 2016 resistance level. Technically, and by looking at the 240-minute chart, we find that the simple moving average continues the …

Read More »Euro is below the support line 16/5/2023

Narrow sideways trading dominated the movements of the euro-dollar pair during the first trading of this week, maintaining the negative path and recording its lowest level at 1.0843. On the technical side today, and with a closer look at the 240-minute chart, we find the euro stable below the previously …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations