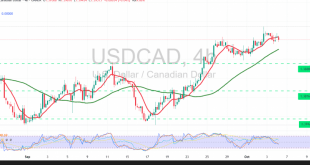

The USD/CAD pair continues to show gradual upward movement, maintaining its recent bullish tone as technical indicators remain supportive of a continuation in the prevailing trend. Technical Outlook – 4-hour timeframe: The Relative Strength Index (RSI) continues to provide positive short-term signals, reflecting steady bullish momentum. Meanwhile, the price remains …

Read More »Pound Faces Downward Pressure 6/10/2025

The GBP/USD pair continues to trade under pressure on the intraday level, moving lower as it approaches the key psychological resistance at 1.3500. Technical Outlook – 4-hour timeframe: The Relative Strength Index (RSI) continues to issue negative signals, reflecting persistent bearish momentum on short-term timeframes. Meanwhile, the 50-day Simple Moving …

Read More »Oil Holds Above Resistance 6/10/2025

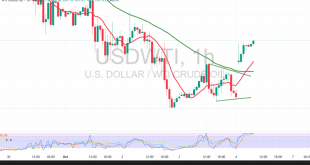

US crude oil futures (WTI) started the week with a bullish price gap, reaching a high of $61.88 per barrel. Technical Outlook – 4-hour timeframe: The price is attempting to consolidate above the $61.50 resistance level, supported by positive signals from the Relative Strength Index (RSI), despite entering overbought territory. …

Read More »Unstoppable Bullish Momentum — Is Gold Heading Toward $4,000? 6/10/2025

Gold prices continue to reach new record highs, starting the week with sharp gains during Asian trading, touching $3,933 per ounce. Technical Overview: 50-Day Simple Moving Average (SMA): The price remains firmly above this level, providing dynamic support that continues to strengthen the bullish momentum. Relative Strength Index (RSI): Despite …

Read More »Euro Steady Below Resistance 6/10/2025

The pair maintains its expected downward trajectory, having repeatedly failed to break the 1.1760 resistance level over several consecutive sessions. Technical Picture: 50-Day Simple Moving Average (SMA): The pair continues to trade below this level, which acts as dynamic resistance, limiting any further upside attempts. Relative Strength Index (RSI): Recently …

Read More »Dow Jones Extends Gains 3/10/2025

The index continues its advance on Wall Street, gradually approaching the 47,000 psychological barrier. Technical Picture: 50-day SMA: Provides consistent support, reinforcing the prevailing bullish bias. RSI: Maintains positive signals on short-term timeframes, reflecting sustained upward momentum. Probable Scenario: Bullish Case (preferred): As long as daily trading consolidates above 46,660, …

Read More »CAD Gets a Positive Boost 3/10/2025

The pair maintained its bullish momentum, reaching the official target at 1.3970 and recording a session high of 1.3986. Technical Outlook: RSI: Continues to issue positive short-term signals, reflecting sustained bullish momentum. 50-day SMA: Price action remains above the moving average, providing dynamic support to the uptrend. Probable Scenario: Bullish …

Read More »Pound Gives Up Its Gains 3/10/2025

The pair extended its bearish trajectory in line with expectations, reaching the first downside target at 1.3430 and printing a session low of 1.3401. Technical Outlook: RSI: Cleared the oversold zone from the prior session but continues to show weak momentum, reflecting limited buying strength. 50-day SMA: Still acting as …

Read More »Oil Suffers Heavy Losses 3/10/2025

US crude oil futures faced heavy selling pressure in the last session, sliding to a low of $60.42 per barrel. Technical Outlook: Moving Averages: The simple moving averages continue to weigh on price from above, with the 50-day SMA converging near 61.80, reinforcing resistance. RSI: The index is in oversold …

Read More »Spotlight on Gold: Profit Booking or Structural Decline? 3/10/2025

After reaching a record high of $3,897, gold prices faced heavy profit-taking, retreating to $3,819 before attempting to stabilize. Technical Outlook: 50-day SMA: Price action remains supported above the moving average, preserving the broader bullish structure. RSI: Currently sending negative signals, reflecting weaker momentum and creating intraday volatility. Trend Bias: …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations