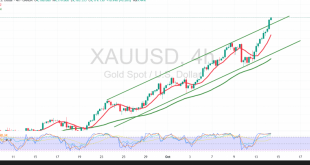

Gold (XAU/USD) extended its record-setting run in early trade, printing a new all-time high at $4,242/oz on firm safe-haven demand. Price action is holding above $4,155 and well above the $4,000 psychological pivot, confirming role-reversal support. Up-sloping simple moving averages keep bullish momentum intact, while RSI has cooled from overbought …

Read More »Double Bottom for the Euro — Is It Time to Rebound? 16/10/2025

The pair staged a clear rebound after breaking above 1.1630, prompting a short-term reversal of the bearish tone that dominated recent sessions. Technical Overview Trend context: While the broader structure remains bearish, price action is showing a bullish sub-trend intraday. SMAs: The simple moving averages have flipped to dynamic support, …

Read More »CAD Forms Solid Support 14/10/2025

The pair continues its gradual advance in line with our positive bias, edging toward the prior target after printing a session high at 1.4046. Technical Overview Momentum: The RSI maintains constructive short-term signals, consistent with ongoing bullish momentum. Trend filter: Price action remains above the 50-period SMA, reinforcing the prevailing …

Read More »Pound Steady Below Resistance 14/10/2025

The GBP/USD pair extended its decline within the bearish trend anticipated in the previous report, reaching a low of 1.3315 as selling pressure continued to dominate market sentiment. Technical Overview Relative Strength Index (RSI): The indicator continues to issue negative signals despite approaching oversold levels, confirming the strength and persistence …

Read More »Oil: Downside Risks Still Persist 14/10/2025

U.S. crude oil futures attempted to recover a portion of their previous losses, reaching an intraday high of $60.14 per barrel during the prior trading session. However, the broader trend remains under pressure amid persistent bearish sentiment. Technical Overview The simple moving averages (SMAs) continue to weigh on price action …

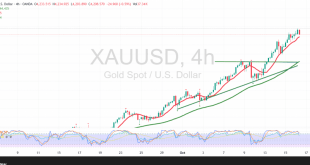

Read More »Gold: Temporary Reversal or Sustained Momentum? 14/10/2025

Gold prices continue to post sharp consecutive gains, extending the strong bullish trend and marking a new record high at $4,180 per ounce at the time of writing. The move is supported by increased demand for safe-haven assets amid persistent market uncertainty. Technical Overview The price has successfully stabilized above …

Read More »Euro Weighed Down by the Dollar 14/10/2025

The EUR/USD pair remains under broad downside pressure, consistent with the bearish trend highlighted in previous reports. The pair extended its gradual decline, recording a new low near 1.1555, as sellers continue to dominate market sentiment. Technical Overview The overall trend remains decisively bearish, with price action holding below the …

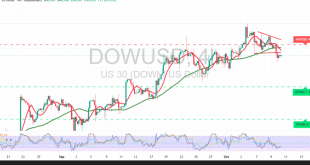

Read More »Dow Jones Faces Downward Pressure 10/10/2025

The Dow Jones Industrial Average declined during the previous Wall Street session after testing the 46,930 resistance level, which triggered renewed selling pressure and a shift toward negative price action. Technical Overview 50-Period Simple Moving Average (SMA): The index remains under pressure from the SMA, which continues to act as …

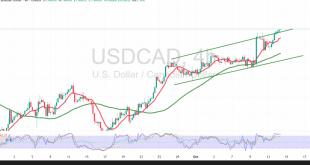

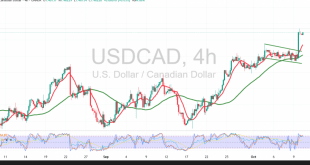

Read More »Canadian Dollar Extends Its Gains 10/10/2025

The USD/CAD pair extended its gradual upward movement, successfully breaching the key psychological resistance at 1.4000, reaching the target level of 1.4020 and marking an intraday high at 1.4034. Technical Overview The Relative Strength Index (RSI) continues to issue short-term positive signals, supporting the prevailing bullish momentum. Meanwhile, the pair …

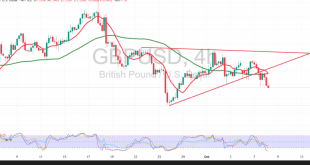

Read More »Pound Faces Selling Pressure 10/10/2025

The GBP/USD pair extended its sharp decline within the bearish framework highlighted in the previous report, breaking below the projected downside target at 1.3320 and recording a new low near 1.3280. Technical Overview Relative Strength Index (RSI): Despite entering oversold territory, the indicator continues to send negative signals, reflecting persistent …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations