Oil, Crude, trading

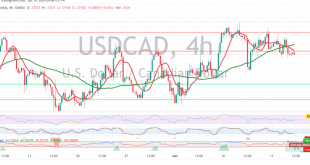

Read More »USD/CAD: Bearish Bias Dominates Amid Downward Pressure 19/6/2024

The USD/CAD pair is experiencing a downward trend, primarily due to the collision with the 1.3760 resistance level, which has capped recent gains and limited the upward momentum. Technical Outlook: Technical analysis suggests a prevailing bearish bias. This is supported by the negative crossover of the simple moving averages, which …

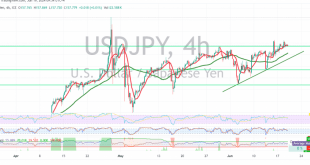

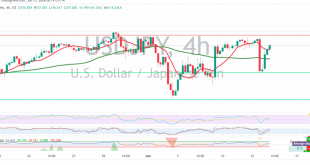

Read More »USD/JPY: Calm Trading Upholds Bullish Momentum 19/6/2024

japanese-yen

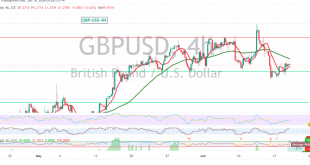

Read More »GBP/USD: Cautious Optimism as GBP Attempts to Break Resistance 19/6/2024

Oil, Crude, trading

Read More »WTI: Bullish Momentum Strengthens, Eyes on $80 19/6/2024

WTI crude oil futures prices are on the rise, targeting the $80.00 per barrel threshold. Technical Outlook: Our analysis remains bullish, bolstered by the price finding support above the critical 79.65 level and the continued positive momentum provided by the simple moving averages. Upward Potential: The upward trend appears poised …

Read More »Gold: Bearish Flag Formation Suggests Further Downside 19/6/2024

Gold prices remain confined within a narrow sideways range, bounded by the 2313 support level and the 2340 resistance level. Technical Outlook: Analysis of the 240-minute chart reveals a bearish flag pattern formation, indicating a potential continuation of the downward trend. The 50-day simple moving average is exerting negative pressure, …

Read More »EUR/USD: Downward Pressure Persists Despite Positive Attempts 19/6/2024

The EUR/USD pair showed positive movements at the end of last week, but the upside remains limited as the pair failed to break above the 1.0760 resistance level. Technical Outlook: On the 4-hour chart, the 50-day simple moving average (SMA) continues to act as a significant barrier around the 1.0760 …

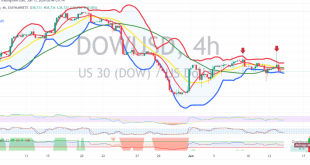

Read More »Dow Jones Industrial Average Technical Analysis: Cautionary Negative Outlook 13/6/2024

Oil, Crude, trading

Read More »USD/CAD Technical Analysis: Uptrend Continuation Expected Amidst Positive Momentum 13/6/2024

The USD/CAD pair continues to exhibit a strong upward trend, bolstered by its firm footing above the crucial support level of 1.3690. Technical Outlook Our technical analysis suggests a continuation of the uptrend. The positive momentum derived from the simple moving averages, coupled with the Relative Strength Index’s (RSI) attempts …

Read More »USD/JPY Technical Analysis: Upward Trend Remains Intact, but Caution Warranted 13/6/2024

japanese-yen

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations