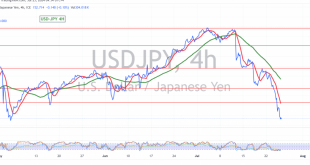

japanese-yen

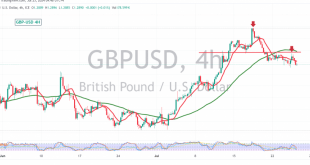

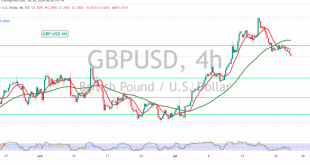

Read More »British Pound Maintains Bearish Trend Against US Dollar 25/7/2024

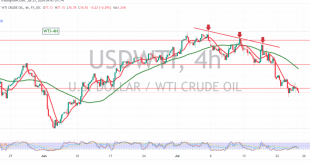

Oil, Crude, trading

Read More »Oil: a triple top pressure the price 25/7/2024

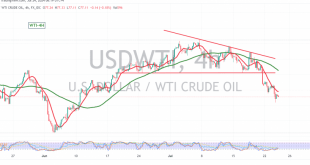

During the previous trading session, US crude oil futures encountered a psychological resistance barrier at $78.00, which dampened the upward momentum. From a technical perspective, today’s outlook leans toward negativity, supported by a bearish technical structure on the 4-hour chart and the simple moving averages indicating ongoing negative pressure from …

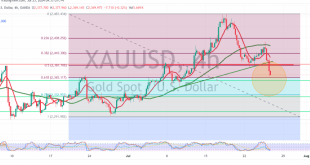

Read More »Gold Prices Decline After Failing to Break Key Resistance 25/7/2024

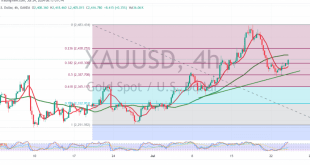

In the previous report, we maintained a neutral stance due to conflicting technical signals, noting that stability above the 2410 resistance level might lead gold prices to target 2426 and 2438. Gold prices reached 2432, achieving the first target. Today, from a technical perspective, gold prices have rapidly declined after …

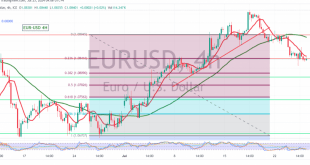

Read More »Euro Declines Against US Dollar with Potential for Further Downside 25/7/2024

The euro continues to decline against the US dollar, adhering to the expected bearish trend after reaching the first target of 1.0840 as indicated in the latest report. Technically, the 240-minute chart reveals negative crossover signals from the simple moving averages, which support the likelihood of continuing the downward trend. …

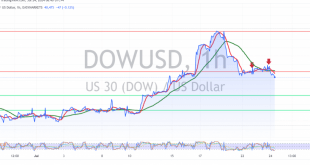

Read More »Dow Jones Faces Continued Downward Pressure 24/7/2024

Oil, Crude, trading

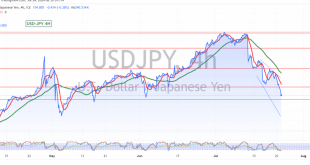

Read More »USD/JPY Pair Sees Accelerated Downward Trend with Key Levels in Sight 24/7/2024

japanese-yen

Read More »US Dollar Puts Pressure on British Pound, Key Support Levels in Focus 24/7/2024

Oil, Crude, trading

Read More »US Crude Oil Futures Hit Key Targets Amid Continued Downward Trend 24/7/2024

US crude oil futures experienced significant losses, aligning with the anticipated downward trend, reaching the official targets at 77.60 and 76.85, and recording a low of $76.43 per barrel. From a technical perspective, the simple moving averages continue to support the bearish wave, bolstered by the Relative Strength Index (RSI), …

Read More »Gold Prices Show Positivity Amid Technical Conflicts 24/7/2024

Gold prices started today’s trading session with noticeable positivity after finding strong support near 2388, prompting an upward bounce. Currently, the price is stable around 2416. From a technical analysis standpoint, the 240-minute chart indicates that the price has stabilized above the 2410 resistance level, aligned with the 38.20% Fibonacci …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations