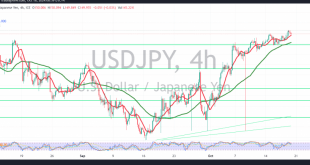

japanese-yen

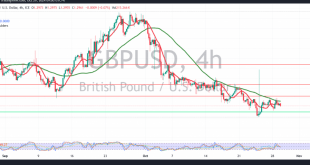

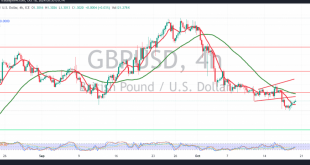

Read More »GBP faces negative pressure 29/10/2024

Oil, Crude, trading

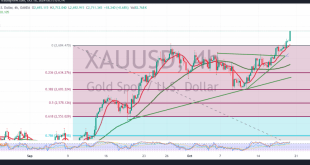

Read More »Gold records lower highs 29/10/2024

Gold prices are currently showing positive momentum as they attempt to breach the recent peak of $2758 per ounce. Technical Analysis: Analyzing the 4-hour chart, gold has started forming lower peaks, suggesting a potential continuation of a downward correction. The Stochastic indicator is also providing negative signals, indicating a possibility …

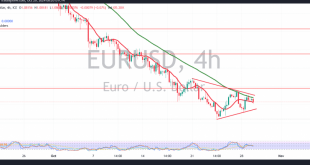

Read More »Euro awaits confirmation of break 29/10/2024

The EUR/USD pair has been trading sideways, attempting to hold above the support level of 1.0760. However, positive movement has been limited, with the pair struggling to rise above the main resistance at 1.0850. Technical Analysis: On the 240-minute chart, the 50-day simple moving average indicates potential for further decline, …

Read More »Bank of Canada Poised for Significant Rate Cut Amid Economic Concerns

The Bank of Canada (BoC) is expected to deliver a major policy shift on Wednesday by cutting its key interest rate by 50 basis points, in response to mounting concerns about inflation, sluggish economic growth, and softening labor markets. Economists widely anticipate this will mark the central bank’s first outsized …

Read More »Dow Jones recovers 18/10/2024

Oil, Crude, trading

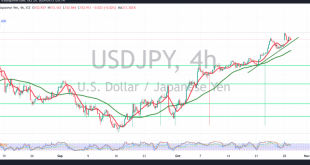

Read More »USDJPY achieves bullish target 18/10/2024

japanese-yen

Read More »GBP holds below resistance 18/10/2024

Oil, Crude, trading

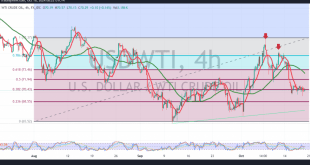

Read More »Oil hits target 18/10/2024

US crude oil futures have successfully reached the first downward target at $69.65 per barrel, recording a low of $69.45. Technical Outlook: Today’s analysis suggests the potential for the downtrend to continue, with the bearish double top pattern on the 4-hour chart maintaining its negative influence. The downward pressure is …

Read More »Gold hits new historic highs 18/10/2024

Gold prices reached a new record high of $2712 per ounce, aligning with the upward momentum highlighted in the previous analysis. The breach of the 2685 level led to the anticipated new highs of 2691 and 2700. Technical Outlook:The technical indicators suggest continued bullish momentum, with the simple moving averages …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations