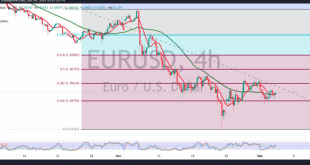

Narrow sideways trading dominates the movements of the euro against the US dollar, confined from below above 1.0480 and from above without resistance 1.0510. On the technical side today, and with a closer look at the 4-hour chart, we find that the simple moving averages still support the possibility of …

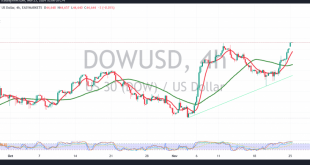

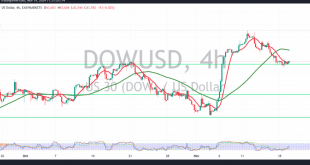

Read More »Dow Jones Repeats Upside Chances 25/11/2024

Oil, Crude, trading

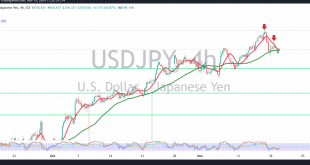

Read More »USD/JPY may continue downward correction 25/11/2024

japanese-yen

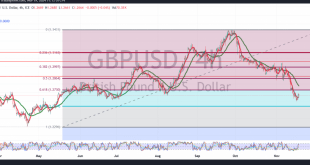

Read More »GBP attacks resistance 25/11/2024

Oil, Crude, trading

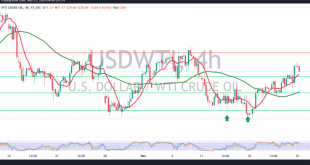

Read More »Oil is based on support 25/11/2024

US crude oil futures closed last week’s trading on a positive note, reaching a high of $71.47 per barrel. From a technical standpoint, the outlook remains optimistic, supported by the price’s ability to stabilize above the key support level of $70.60. Additionally, the RSI is showing attempts to gain further …

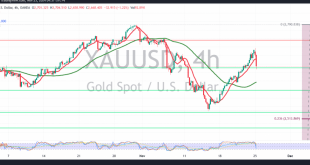

Read More »Gold to be monitored 25/11/2024

Gold resumed its bullish momentum during the previous session, surpassing the official target of $2700 per ounce and recording its highest level at $2720. From a technical perspective, the current movement shows a slight bearish tendency due to encountering the pivotal resistance at $2720. However, a closer look at the …

Read More »Euro tries to recover 25/11/2024

The EUR/USD pair attempted a recovery after several sessions of decline, hitting a low of 1.0330 before opening today’s trading with an upward gap. Technical Outlook: Indicators: The 4-hour chart reveals negative crossover signals from the Stochastic indicator, now in the overbought zone, coupled with continued downward pressure from the …

Read More »Dow Jones steady below resistance 19/11/2024

Oil, Crude, trading

Read More »USD/JPY may start downward correction 19/11/2024

japanese-yen

Read More »GBP awaits confirmation signal in the short term 19/11/2024

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations