Oil, Crude, trading

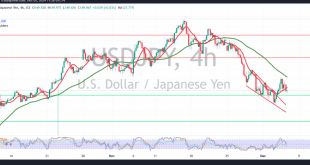

Read More »USD/JPY Waiting for Stronger Trend Signal 5/12/2024

japanese-yen

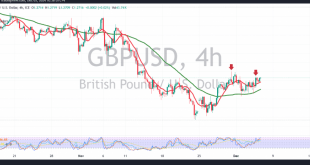

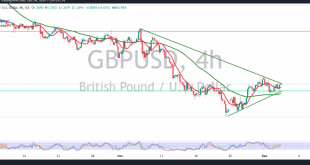

Read More »GBP faces strong resistance 5/12/2024

Oil, Crude, trading

Read More »Oil awaits new move signal 5/12/2024

US crude oil futures demonstrated the anticipated upward trend outlined in the previous technical report, supported by trading stability above the key level of 68.90. Technical Analysis: Bearish Indicators: The simple moving averages apply continued downward pressure. The 14-day momentum indicator reflects clear negative signals, favoring a bearish outlook. Scenario …

Read More »Gold is moving in a sideways range 5/12/2024

Gold continues to exhibit a sideways trend, trading within a narrow range confined between the support level at 2635 and resistance level at 2657 for several consecutive sessions. Technical Analysis: Positive Signals: The 50-day simple moving average provides upward pressure, hinting at the possibility of a bullish breakout. Negative Signals: …

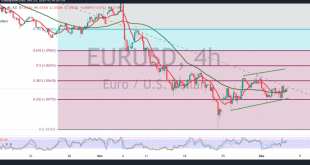

Read More »Euro loses momentum 5/12/2024

The EUR/USD pair showed a modest upward trend, benefiting from the support level of 1.0470, and reached a session high of 1.0544 during the previous trading day. Technical Analysis: The pair struggled to break the critical resistance at 1.0540, as noted in the previous analysis. On the 4-hour chart, the …

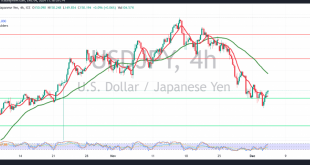

Read More »USD/JPY Below Resistance 4/12/2024

japanese-yen

Read More »GBP under negative pressure 4/12/2024

Oil, Crude, trading

Read More »Oil starts positive 4/12/2024

US crude oil futures displayed bullish attempts in the previous session, reaching a high of $70.20 per barrel. From a technical perspective, the outlook remains positive, supported by the bullish crossover of simple moving averages that align with the daily upward trajectory. Furthermore, the price stability above the key support …

Read More »Gold needs to find a stronger direction 4/12/2024

Gold continues to exhibit sideways movement, with prices stabilizing above the support level at 2634 and below the pivotal resistance at 2658. From a technical perspective, the 4-hour chart reflects conflicting signals. The 50-day simple moving average exerts downward pressure, favoring a bearish trend, while the 14-day momentum indicator provides …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations