Gold prices sustained a robust upward trend as anticipated in the previous report, reaching the target of $2720 and recording a peak at $2726 per ounce. Technical Analysis A detailed examination of the 4-hour chart reveals: Positive Signals: The simple moving averages continue to bolster the upward trajectory. The 14-day …

Read More »Euro faces negative pressure ahead of ECB 12/12/2024

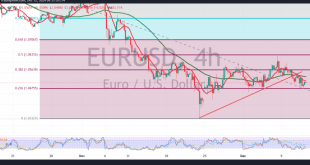

The Euro continued its retreat against the US Dollar during the previous session, aligning with the anticipated negative outlook, reaching the first target of 1.0475 and recording a low of 1.0479. Technical Analysis An analysis of the 240-minute chart indicates: Bearish Factors: The simple moving averages are exerting downward pressure. …

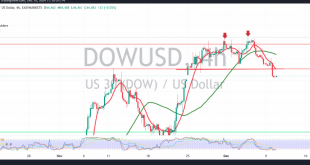

Read More »Dow Jones needs a closer look 11/12/2024

Oil, Crude, trading

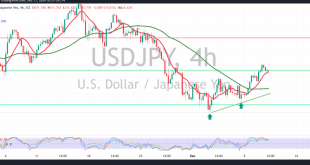

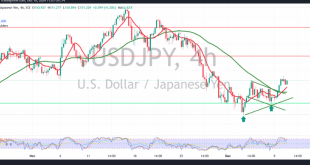

Read More »USD/JPY Needs More Momentum 11/12/2024

japanese-yen

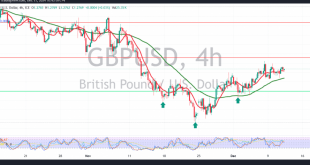

Read More »GBP maintains positive stability 11/12/2024

Oil, Crude, trading

Read More »Oil breaks resistance 11/12/2024

US crude oil futures prices reacted to the anticipated downward trend highlighted in the previous analysis. The scenario relied on trading stability below the key resistance level of 68.60. As expected, an upward move and stability above 68.60 negated the bearish outlook, resulting in a price increase to $69.08 per …

Read More »Gold hits targets, eyes on inflation 11/12/2024

Gold prices continued their upward trend, as anticipated in the previous technical report, reaching the required target at $2700 per ounce and recording a peak of $2704. From a technical standpoint today, the 4-hour chart reveals the stability of intraday trading above the breached resistance level, now acting as support …

Read More »Euro hits resistance 11/12/2024

The EUR/USD pair encountered strong resistance around 1.0660, forcing it to retreat under negative pressures, marking its lowest level during the previous session at 1.0498. Technically, the 240-minute chart reveals the return of simple moving averages exerting downward pressure on the price, coupled with bearish signals from the Stochastic indicator. …

Read More »Dow Jones touches desired targets 10/12/2024

Oil, Crude, trading

Read More »USD/JPY Draws Bullish Pattern 10/12/2024

japanese-yen

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations