Oil, Crude, trading

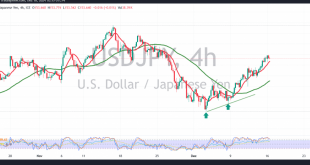

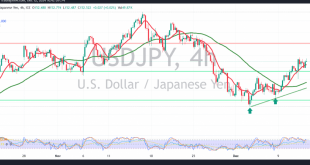

Read More »USD/JPY Continues Upward Rally 16/12/2024

japanese-yen

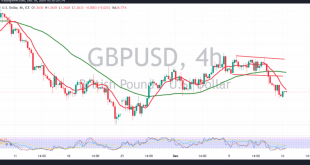

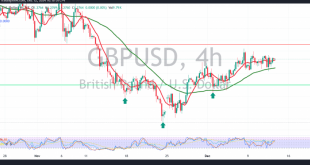

Read More »GBP tends to be negative 16/12/2024

Oil, Crude, trading

Read More »Oil may repeat attempts to rise 16/12/2024

Mixed trading dominated the movements of US crude oil futures, with prices reaching the initial target highlighted in the previous technical report at 71.10, and recording a high of $71.38 per barrel. From a technical perspective, the 240-minute chart indicates that prices are currently stabilizing above the minor support level …

Read More »Gold faces negative pressure 16/12/2024

Gold prices followed the expected upward trend outlined in the previous technical report, where the stability of trading above the 2678 support level was highlighted. However, as noted, breaking the 2670 support level would halt the bullish scenario, placing gold under negative pressure. This scenario materialized, with prices reaching a …

Read More »Euro awaits negative stimulus 16/12/2024

The EUR/USD pair experienced negative trading towards the end of last week’s sessions, exerting pressure on the support level of 1.0470 and recording a low of 1.0453. Technically, the pair is showing attempts at a bullish bounce due to its temporary stability above the strong support at 1.0470. However, the …

Read More »Dow Jones faces negative pressure 12/12/2024

Oil, Crude, trading

Read More »USD/JPY Jumps Higher 12/12/2024

japanese-yen

Read More »GBP repeats the chances of rising 12/12/2024

Oil, Crude, trading

Read More »Oil extends gains 12/12/2024

US crude oil futures experienced significant upward momentum, breaking the pivotal resistance level of $68.60 to achieve the anticipated targets from the previous session, reaching $70.50 per barrel. Technical Analysis A closer examination of the 4-hour chart reveals: Support Levels: The price currently holds above minor support at $69.60, with …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations