Oil, Crude, trading

Read More »Oil to be monitored 21/2/2025

U.S. crude oil futures continued their upward momentum for the third consecutive session, reaching a high of $73.11 per barrel. Technical Analysis On the 4-hour chart, a bullish crossover of the simple moving averages (SMA) supports the potential for further gains. However, Stochastic indicators suggest a loss of upward momentum, …

Read More »Gold: Retest Scenario 21/2/2025

Gold Hits Record Highs Before Facing Profit-Taking Pressure Gold prices extended their rally in the previous trading session, surpassing the key $2,950 per ounce target and reaching a new high of $2,954. Technical Analysis Despite the strong long-term bullish trend, intraday movements indicate a bearish pullback due to profit-taking and …

Read More »Euro attacks psychological barrier 21/2/2025

The EUR/USD pair maintained its upward trajectory during the previous trading session, aligning with expectations outlined in the last technical report. The pair is now testing the psychological resistance level of 1.0500, signaling potential for further gains. Technical Outlook A closer look at the 4-hour chart indicates strong bullish momentum, …

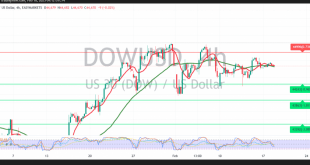

Read More »Dow Jones Seeks Extra Momentum 18/2/2025

Oil, Crude, trading

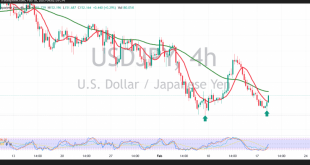

Read More »USD/JPY: Retests Resistance 18/2/2025

japanese-yen

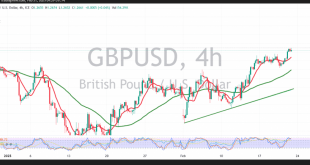

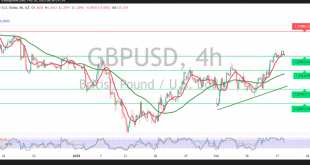

Read More »GBP attacks psychological barrier 18/2/2025

Oil, Crude, trading

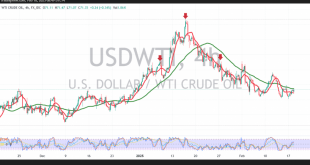

Read More »Oil awaits negative stimulus 18/2/2025

US Crude Oil (WTI) Technical Analysis US crude oil futures saw temporary positive movements, reaching $71.47 per barrel during this morning’s trading. Technical Outlook: Bearish Signals: The simple moving averages (SMA) continue to pressure the price from above. The Stochastic indicator is losing upward momentum, signaling potential weakness. Key Support …

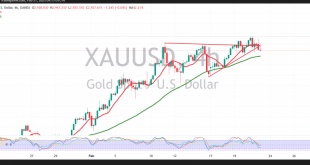

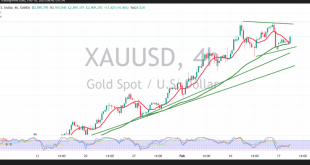

Read More »Gold tries to regain the upward path 18/2/2025

Gold (XAU/USD) Technical Analysis Gold prices began today’s trading with an upward trend after last Friday’s decline and profit-taking pushed prices down to $2878 per ounce. Technical Outlook: Bullish Signals: The price remains stable above the 50-day simple moving average (SMA). Intraday support is confirmed at 2887, with a broader …

Read More »Euro retests support 18/2/2025

EUR/USD Technical Analysis The EUR/USD pair successfully reached the official target of 1.0500, marking a high of 1.0506 in the previous session. Technical Outlook: Key Resistance & Support Levels: The pair faced resistance at 1.0500, leading to a bearish bias toward the 1.0450 support level. The 50-day simple moving average …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations