The Euro found a solid support floor near the last official target to be achieved, located at 1.2020, which push it to bounce back up to restore the resistance level mentioned in the previous analysis at 1.2090. Technically speaking, and by looking at the 240-minute chart, we find the pair …

Read More »Bitcoin Achieves Historic Peaks

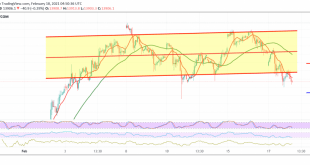

Bitcoin continues to achieve record levels, hitting 52,518 in a series of successive gains, as risk appetite in the markets improves. On the technical side today, we tend to be negative in our trades, but cautiously given the high level of risks, relying on intraday trading below 52,500 accompanied by …

Read More »German DAX: May Witness a Negative Bias

The German DAX index declined significantly. surpassing the official target required to be achieved during the previous analysis at a price of 13,955, recording the lowest 13,874. Technically, we tend to be negative in our trades, but cautiously, depending on trading stability below the previously broken support-into-resistance at 13,990, accompanied …

Read More »Dow Jones Getting a Positive Signal

Mixed trades dominated the movements of the Dow Jones Industrial Average during the last session’s trading. We indicated that the breach of the 31,550 minor resistance level will immediately stop the expected scenario and restore the index to recover again to complete the official bullish path with a target of …

Read More »GBP/JPY: Awaits Pending Orders

A gradual decline to the downside dominated the movement of the pound sterling against the Japanese yen, after finding a strong resistance level near 147.50 within a bearish tendency, recording the lowest price at 146.40. On the technical side, today there is a conflict between the obvious positive signs on …

Read More »Canadian Dollar Touches First Target of Bullish Correction

The Canadian dollar provided positive trades during the previous trading session within the technique of re-testing the resistance indicated during the previous analysis at 1.2740, recording its highest level at 1.2746. Technically, we find the price is stable above the previously breached resistance level, which has now turned to the …

Read More »Pound Pressing Support

Oil, Crude, trading

Read More »Oil Retested Support

Oil, Crude, trading

Read More »Gold And Selling Pressure Continues

Gold prices were exposed to a strong downward wave, as we expected in the previous analysis, touching the first target to be achieved at 1777, approaching a few points from the official target of 1765, to record the lowest price of 1769. Technically, the intraday trading remains below the resistance …

Read More »Euro Touches Bearish Targets And Negativity Remains

The Euro managed to achieve the bearish scenario, as we expected and mentioned in the previous analysis, after it confirmed the break of 1.2085, heading directly towards the second official target of 1.2020. Technically speaking, and by looking at the 240-minute chart, we find the pair is stable below the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations