Oil, Crude, trading

Read More »Oil Prices Face Downward Pressure 28/5/2025

U.S. crude oil futures are trading with a negative bias, despite brief intraday attempts to stabilize. The price is currently hovering near $61.20 per barrel, reflecting continued selling pressure. From a technical perspective, oil prices remain below the 50-day simple moving average, which acts as a key dynamic resistance at …

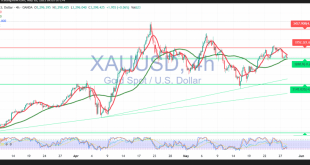

Read More »Gold Attempts to Build Further Momentum 28/5/2025

Gold prices are currently trading within a narrow range, consolidating between $3,300 support and $3,350 resistance. This consolidation reflects a pause in momentum following recent gains, as the market awaits key catalysts. From a technical perspective, the underlying bullish trend remains intact. The Relative Strength Index (RSI) is showing signs …

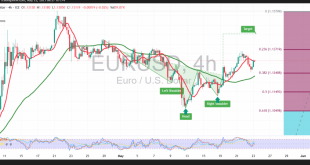

Read More »Euro Testing for a Potential Bottom 28/5/2025

The EUR/USD pair experienced a pullback after successfully reaching the official target at 1.1410, recording a high of 1.1407 in the previous session. This rejection from the psychological resistance level has led to renewed selling pressure. On the 4-hour chart, we see that 1.1400 remains a key resistance, as the …

Read More »Selling Pressure on the Dow Jones Continues 23/5/2025

Oil, Crude, trading

Read More »CAD Heads Toward Downside Targets 23/5/2025

As anticipated, the downtrend continues to dominate USD/CAD, following the pair’s failure to maintain stability above the psychological resistance at 1.3900. This rejection has led to renewed selling pressure and a shift to negative intraday momentum. From a technical perspective, the 4-hour chart reveals that 1.3900 remains a key resistance …

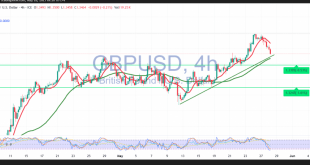

Read More »GBP Pushes Higher Versus the Greenback 23/5/2025

Oil, Crude, trading

Read More »Oil May Extend Its Decline 23/5/2025

U.S. crude oil futures posted significant losses in line with the previously outlined bearish scenario, reaching the first official downside target at $60.45 and recording a session low of $60.27 per barrel. From a technical standpoint, oil prices are currently trading below the 50-day simple moving average, which is acting …

Read More »Gold Moves in Line with the Uptrend Line 23/5/2025

The key support level at $3,260, highlighted in the previous report, successfully limited the downside in gold prices during the prior session. Early European trading today has opened with a stable advance above the psychological $3,300 level, reinforcing the bullish structure. From a technical perspective, the uptrend remains intact. The …

Read More »Euro Holds Above Support, Renews Upside Potential 23/5/2025

Despite a limited bearish bias during yesterday’s session, the EUR/USD pair rebounded into positive territory in early trading today, finding support at the 1.1270 level — as highlighted in the previous technical report. On the 4-hour chart (240-minute timeframe), the pair remains above the psychological barrier at 1.1300, supported by …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations