Gold prices saw large, broad movements during the previous trading session, fueled by strong upward momentum that pushed the price to a high of $3,392 per ounce. From a technical perspective, the 4-hour chart shows that the simple moving averages continue to support the daily uptrend. However, negative signals are …

Read More »Euro Aims for Further Gains 3/6/2025

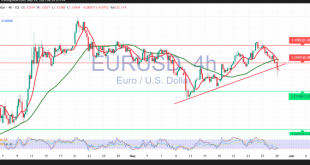

Positive trading dominated the EUR/USD pair’s movements during the first trading session of the week, benefiting from weakness in the U.S. dollar. The pair reached a session high of 1.1455. From a technical perspective, the bias remains tilted toward positivity, supported by the pair’s stability above the simple moving averages, …

Read More »Dow Jones Could Extend Its Gains 29/5/2025

Oil, Crude, trading

Read More »CAD Attempts a Recovery 29/5/2025

Positive trading has returned to the Canadian dollar after it found solid demand near the psychological barrier of 1.3800, sparking a modest upward bounce. From a technical perspective, the 4-hour chart shows the pair attempting to shake off the negative pressure stemming from overbought conditions, while the simple moving averages …

Read More »GBP Pressures Support 29/5/2025

Oil, Crude, trading

Read More »Oil Holds Above the Support Line 29/5/2025

US crude oil futures reversed the expected downward trend outlined in the previous technical report, which was based on trading stability below the key resistance level at $61.90. Instead, the market shifted to a more positive tone, with intraday movements showing a clear upside bias. Prices are currently hovering near …

Read More »Gold starts negatively 29/5/2025

Gold prices achieved the first upside target at $3,311 at the start of the European trading session, reaching a high of $3,325, though gains remained modest. As highlighted in the previous report, price consolidation at $3,270 was expected to halt the bullish momentum and apply negative pressure, potentially triggering a …

Read More »Euro Breaks Below Key Support Level 29/5/2025

The euro weakened against the U.S. dollar in the previous session after encountering strong resistance at 1.1350, aligning with the target highlighted in the previous report. The pair recorded a session high of 1.1345 before retreating sharply. As expected, an hourly candle close below 1.1270 has postponed the upside potential, …

Read More »Dow Jones extends gains 28/5/2025

Oil, Crude, trading

Read More »CAD may hit major resistance 28/5/2025

The Canadian dollar has resumed its intraday rise, attempting to recover losses from previous sessions after touching the 1.3722 level. From a technical analysis perspective today, and by closely examining the 4-hour chart, we find the pair hovering near the key resistance level of 13850. This resistance meets the 50-day …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations