Oil, Crude, trading

Read More »Crude Oil Continues to Gain

Oil, Crude, trading

Read More »Gold Hits Resistance, Eyes on NFP

We adhered to intraday neutrality during the previous analysis, due to the exposure of technical signals, to find that gold prices collided with the strong resistance level published during the previous report at 1782, which we mentioned to represent one of the most important trend keys for the current trading …

Read More »The Euro Continues to Decline Against The Dollar

The euro continues to resume the bearish path against the US dollar within a gradual decline to the downside, approaching the official target of 1.1840 by a few points, at the second target 1.1810, posting its lowest level at 1.1835. On the technical side, and with the continuation of the …

Read More »The German Dax Continues to Rising

Positive trading continues to dominate the German DAX index, recording its highest level at 15,694. On the technical side, we tend to the positivity in our trading, relying on the stability of trading above the 15,445 support floor, accompanied by the positive motive coming from the 50-day moving average, coinciding …

Read More »Dow Jones Achieves Strong Gains And The Positivity Continues

Oil, Crude, trading

Read More »GBP/JPY:ِ May Witness a Temporary Bullish Bias

The Pound against the Japanese Yen found a good support level around 153.00, to witness the stability of the current movement above the mentioned level. On the technical side today, and by looking at the short intervals, we find stochastic trying to provide positive crossover signals accompanied by the stability …

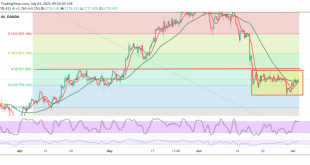

Read More »The Canadian Maintains the Bullish Path

The technical outlook is the same, and the pair’s movements did not change significantly, maintaining the bullish corrective slope as we expected, so that the Canadian could breach the resistance level published during the previous analysis, located at 1.2330. From the angle of technical analysis today, and with careful consideration …

Read More »The Pound Continues to Decline Against The US Dollar

Oil, Crude, trading

Read More »Oil Making Good Gains, And Eyes on OPEC Meeting

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations