As we expected during the previous analysis, an upward trend dominated US crude oil’s performance yesterday, touching the first required target at 89.50, recording its highest level at 89.74. Technically, we tend to trade positively but cautiously, relying on the positive motive from the simple moving average and the positive …

Read More »Gold is in a sideways range, all eyes on Fed 2/11/2022

Negative trading continues to dominate gold’s movements within the expected bearish context, to find the price traded negatively as soon as it approached the pivotal resistance level at 1660, which forced it to retest 1630. Technically, and by looking at the 4-hour chart, we notice the 50-day simple moving average …

Read More »Euro is stable below the parity point 2/11/2022

The single European currency found a good demand area around the posted level during the last analysis at 0.9850 within the bullish rebound attempts that are still limited. Technically, and carefully considering the 4-hour chart, we find the euro is still stable below the parity point against the US dollar, …

Read More »Dow Jones retests support 28/10/2022

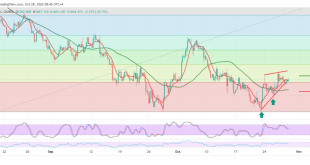

Oil, Crude, trading

Read More »CAD maintains negative stability 28/10/2022

The technical outlook is unchanged, and the movements of the Canadian dollar did not change, maintaining the expected bearish context and the regular movements within the descending channel. Technically and carefully considering the 4-hour chart, we find the simple moving averages continuing their negative pressure on the price from above, …

Read More »GBP retests support 28/10/2022

Oil, Crude, trading

Read More »Oil touches the first target 28/10/2022

A weak bullish trend dominated the movements of US crude oil futures yesterday, within the expected bullish context, touching the first target required to be achieved at 89.60, recording the highest level at 89.80. Technically, we tend in our trading to the positive, but cautiously, relying on the positive stimulus …

Read More »Gold is facing negative pressure 28/10/2022

Narrow sideways trading tended to the negativity that dominated gold’s movements during the previous session, under pressure from the rise of the US dollar, reaching the lowest of 1654, after it failed to cross upwards to the resistance level of 1670. Technically, the 50-day simple moving average is trying to …

Read More »Euro presses support amid conflicting technical signals 28/10/2022

The single European currency reversed the bullish trend despite the European Central Bank raising interest rates by 75 basis points to return to stability below 1.0000. On the technical side, we find the 50-day simple moving average still carrying the price from below, supporting the possibility of a rise. On …

Read More »Dow Jones maintains a positive consistency 26/10/2022

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations