The pair extended its bullish momentum, hitting the official target at 1.1870 and marking a session high of 1.1878, in line with the previously anticipated scenario. Technical Outlook: Trend Support: Price continues to consolidate above the 50-day SMA, with movement aligned along the ascending trend line, reinforcing the bullish structure. …

Read More »Dow Jones Receives Positive Signals 16/9/2025

The Dow Jones Industrial Average extended its rally on Wall Street, recording a new all-time high of 46,008. Technical Outlook – 4-hour timeframe: The 50-period simple moving average (SMA) continues to underpin the bullish momentum, acting as a dynamic support for price action. Meanwhile, the Relative Strength Index (RSI) is …

Read More »CAD Breaks the Uptrend Support Line 16/9/2025

The USD/CAD pair came under strong selling pressure after failing to sustain stability above the psychological barrier of 1.3800. Technical Outlook – 4-hour timeframe: Intraday price action is tilting downward, with the simple moving averages now acting as dynamic resistance, pressing on the pair from above. In addition, the break …

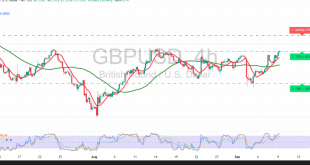

Read More »GBP Faces Potential Support Retest 16/9/2025

The GBP/USD pair posted notable gains in the previous session, reaching 1.3625 before easing into a minor correction after the recent advance. Technical Outlook – 4-hour timeframe: Relative Strength Index (RSI): The indicator has begun issuing negative signals, suggesting a potential short-term weakening in buying momentum. 50-period Simple Moving Average …

Read More »Oil Buyers Are Losing Steam 16/9/2025

US crude oil (WTI) futures advanced at the start of the week, reaching $63.63 per barrel, though the upward momentum still requires confirmation. Technical Outlook – 4-hour timeframe: The 50-period simple moving average continues to support prices from below, providing a solid base for the current move. However, early signs …

Read More »Gold Marches Higher with Buyers in Full Control, Setting New Records! 16/9/2025

Gold prices (XAU/USD) extended their bullish momentum in the previous session, posting fresh record highs at $3,689 per ounce after surpassing the prior peak of $3,678. This confirms strong buying interest and clear investor control over the prevailing uptrend. Technical Outlook – 4-hour timeframe: Relative Strength Index (RSI): Although firmly …

Read More »Euro Nears the Psychological Barrier of 1.1800 — Will It Break Through? 16/9/2025

The EUR/USD pair remains under bullish control, reaching 1.1786 during the session and approaching the psychological barrier at 1.1800. Technical Outlook – 4-hour timeframe: Intraday movements show a mild pullback due to natural profit-taking after the prior rally, with the Relative Strength Index (RSI) issuing negative signals from overbought levels. …

Read More »Dow Jones Attempts to Hold Above Support 9/9/2025

The Dow Jones Industrial Average (DJI30) extended its downward move in line with the expected trajectory outlined in the previous report, with a break below 45,450 increasing selling pressure and driving the index to a low of 45,321. Technical Outlook – 4-hour timeframe: The 50-period simple moving average (SMA) has …

Read More »CAD Hovers Around Resistance 9/9/2025

The USD/CAD pair is consolidating near the psychological resistance at 1.3800, but has yet to achieve a decisive breakout. Technical Outlook – 4-hour timeframe: The 1.3800 level remains a firm resistance zone on short-term charts, while the Relative Strength Index (RSI) is beginning to issue negative signals, reflecting waning momentum …

Read More »Pound Maintains Bullish Momentum 9/9/2025

The technical outlook for the GBP/USD pair remains unchanged, with price action showing little variation as the pair continues its gradual intraday recovery, attempting to hold above the key psychological support at 1.3500. Technical Outlook – 4-hour timeframe: The Relative Strength Index (RSI) has cleared oversold territory and is beginning …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations