Oil, Crude, trading

Read More »CAD starts with negativity, eyes on BoC 12/4/2023

Negative trades dominated the movements of the Canadian dollar within the negative outlook, as we expected during the previous analysis, to start with negative pressure on the support floor published in the last analysis at 1.3480. Technically, the Canadian dollar failed to stabilize over the negative barrier of 1.3500, and …

Read More »GBP: needs to monitor price behavior 12/4/2023

Oil, Crude, trading

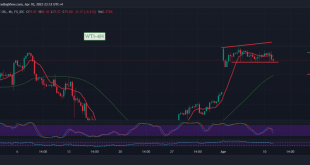

Read More »Oil is rebounding after touching the bearish correction target 12/4/2023

US crude oil futures prices achieved the first corrective decline target published during the previous technical report, located at 79.30, to rebound quickly to the upside. The current movements are hovering around $81.30 per barrel. Technically, the current movements of oil are witnessing stability above the resistance of 80.80, in …

Read More »Gold is on a gradual rise and is looking for additional momentum 12/4/2023

A quiet, gradual rise dominated gold prices during the previous trading session’s dealings within the targeted bullish path, touching the first target to be achieved yesterday at the price of 2004, recording the highest of $2007 per ounce. Technically, and with a closer look at the 240-period chart, we find …

Read More »Euro is hovering around resistance and starting to lose momentum 12/4/2023

Narrow sideways trading dominated the movements of the EUR/USD pair within a bullish path to retest the strong resistance level published during the previous analysis at 1.0920, unable to be breached until now. On the technical side today, the pair’s movements did not show any significant change, and by looking …

Read More »Dow Jones needs a positive catalyst 11/4/2023

Oil, Crude, trading

Read More »CAD waiting for pending orders 11/4/2023

After attempts to rise, the Canadian dollar found a strong resistance level of around 1.3550 to find the resistance above. It started to form negative pressure on the price within a sideways path it cannot breach until now. Technically, we find the Canadian dollar stable above the floor of support …

Read More »GBP is pressing support 11/4/2023

Oil, Crude, trading

Read More »Oil is facing negative pressure and scrutiny is required 11/4/2023

We remained neutral during the last technical report due to conflicting technical signals, explaining that risks are still high amid diverging technical indicators. As a reminder, we indicated that the price’s decline below 80.00 leads oil prices to visit 79.65, recording the lowest 79.66. Technically, we tend to be negative …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations