Quiet, positive trading dominated gold price movements in a bullish context during the previous trading session, recording its highest level at $1963 per ounce. Today’s technical vision indicates the possibility of continuing the rise, depending on the positive impulse from the simple moving averages that support the daily bullish price …

Read More »Euro achieves bullish targets and continues to advance against USD 14/7/2023

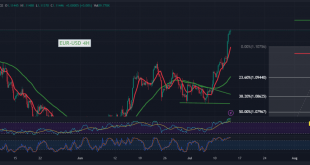

As we expected, the single European currency continued its positive performance against the US dollar, touching the official target station located at 1.1245, recording its highest level at 1.1245 during the early trading of the current session. On the technical side today, by looking at the 4-hour chart, we find …

Read More »Nasdaq touches bullish targets 13/7/2023

Oil, Crude, trading

Read More »Dow Jones maintains positive stability 13/7/2023

Oil, Crude, trading

Read More »CAD stable below support 13/7/2023

Significant negative trades dominated the movements of the Canadian dollar within the expected technical outlook during the previous technical report, touching the official target station 1.3140, recording its lowest level at 1.3142. Technically, and with a closer look at the 240-minute chart, we find that the pair is stable below …

Read More »GBP waiting for more momentum 13/7/2023

Oil, Crude, trading

Read More »Oil may resume rising 13/7/2023

Futures prices achieved good gains during the previous trading session within the expected bullish context, surpassing the first target that should be touched at 75.60 to record its highest level at $76.11 per barrel. The technical outlook remains unchanged; we are positive depending on the price’s consolidation in general above …

Read More »Gold takes advantage of dollar’s weakness. Is $2000 the focus of attention? 13/7/2023

Gold prices recorded significant gains, taking advantage of the weakness of the US dollar, explaining that we are monitoring the price behavior until the breach of the main resistance level of 1945 is confirmed, explaining that this enhances the chances of touching 1961, so that gold prices succeed in recording …

Read More »Euro is aggressively attacking USD 13/7/2023

Remarkably positive trades dominated the movements of the euro-dollar pair within the positive technical outlook, as we expected during the previous report, touching the required targets at 1.1100, close by a few pips to the main target 1.1160, recording its highest level at 1.1148. Technically, and with a closer look …

Read More »Nasdaq is looking for additional momentum 12/7/2023

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations