Investors reacted to underwhelming recent economic data and prepared for the release of key payroll data later this week.Monday’s US manufacturing data for May came in below expectations and indicated that a recent contraction is deepening, albeit slightly.These figures follow other data that suggests the world’s largest economy is slowing …

Read More »Rumours drag USD/JPY lower

USD/JPY has fallen to 155.00 due to a combination of risk-off market sentiment and rumors that the Bank of Japan (BoJ) is considering reducing bond purchases at its June meeting. This move would raise Japanese bond yields and support the Yen, a negative for USD/JPY. The US Dollar (USD) bounced …

Read More »ChatGPT down again after “major outage”

After what OpenAI referred to as a “major outage” earlier today that affected millions of users globally, ChatGPT seems to have recovered. But it appears that the chatbot is having problems once more, as OpenAI reports that it is “unavailable for some users” once more. Reports of today’s ChatGPT issues …

Read More »US JOLTS Job Openings decline below expectations

The number of job openings on the last business day of April stood at 8.059 million, the US Bureau of Labor Statistics (BLS) reported in the Job Openings and Labor Turnover Survey (JOLTS) on Tuesday. This reading followed the 8.35 million (revised from 8.48 million) openings reported in March and …

Read More »Market Drivers; US Session, June 3

The New York Stock Exchange said Monday that a technical issue that halted trading for some major stocks and caused Berkshire Hathaway to be down 99.97% has been resolved. In an update, NYSE said impacted stocks have reopened and “all systems are currently operational.” Inter-continental Exchange, the parent company of …

Read More »Japan’s Suzuki: Early May intervention was in a response to speculations

Japanese Finance Minister Shunichi Suzuki said on Tuesday that foreign exchange (FX) intervention had effects to some effects, adding that the central bank will continue to respond appropriately when asked about forex. At the time of writing, USD/JPY is 0.19% higher on the day trading at 156.38. the USD/JPY pair …

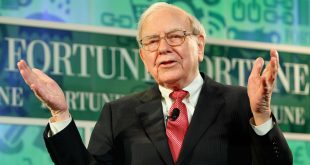

Read More »Why have some of Warren Buffett’s shares dropped by 100%?

On the opening day of the new trading week, there were trading disruptions on the New York Stock Exchange due to a technical issue that resulted in the suspension of trading in certain blue-chip companies and large losses for other equities during Monday’s session.The most severely impacted company by this …

Read More »Brent Falls Below $80 For First Time Since February

The nearest contract for Brent futures dropped 3.59 percent to $78.19 at the time of writing, while the American WTI contract was down 3.43 percent at $74.26. it is worth mentioning that Brent crude oil prices fell to below $80 a barrel on Monday for the first time since February, …

Read More »Dow Jones retreats following ISM PMI

Investors’ growing concerns regarding weakening US data have caused the Dow Jones to reverse. Bets on a November Fed rate drop have taken over in the markets. With a steep decline in stocks on Monday, NFP week officially begins. Investors pulled back after the US ISM Manufacturing Purchasing Managers Index …

Read More »Gold rebounds after US Manufacturing ISM data

Gold recovers from three-week lows after negative US ISM Manufacturing data and fall in US yields. Asian demand and cooling inflation expectations further support Gold’s bounce. Technicals remain bearish after a breakout from a Bear Flag. Gold (XAU/USD) recovers to trade in the $2,340s on Monday after the release of …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations