The Dow Jones Industrial Average (DJI30) has shown a strong upward trend on Wall Street amid a series of record closes for the US stock market. Technical Outlook – 4-Hour Timeframe Technically, the index remains stable above the 50-day Simple Moving Average (SMA), which enhances the chances of a continued …

Read More »Canadian Dollar: Between Correction and Uptrend 20/08/2025

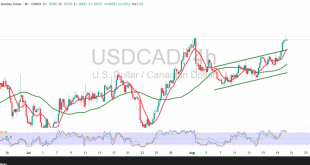

The USD/CAD pair has been dominated by an upward trend after recording repeated closes above the pivotal support level of 1.3800, which reinforces the pair’s positive outlook. Technical Outlook – 4-Hour Timeframe The pair is currently facing a strong resistance level around 1.3880. The Relative Strength Index (RSI) is clearly …

Read More »Pound Sterling Faces Strong Pressure from the USD 20/08/2025

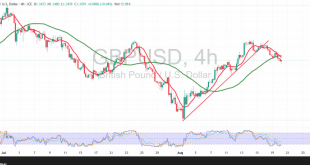

The GBP/USD pair recorded significant declines during the previous trading session, hitting its lowest level at 1.3462. Technical Outlook – 4-Hour Timeframe The pair’s stability below the Simple Moving Average (SMA), which coincides with the previously broken support area now acting as a resistance level at 1.3510, reinforces this level’s …

Read More »Oil Remains on a Bearish Path Despite Rebound Attempts 20/08/2025

WTI crude oil futures have continued to record consecutive losses over several sessions, with the price reaching its lowest level at $61.68 per barrel. Technical Outlook – 4-Hour Timeframe Current price action shows attempted bullish rebounds as the Relative Strength Index (RSI) tries to correct from oversold conditions. Meanwhile, the …

Read More »Weak Upward Momentum Leaves Gold Under Sellers’ Control 20/08/2025

Gold prices (XAU/USD) saw a sharp decline during the previous trading session, continuing the movement anticipated in our last technical report. Prices have already touched the target level of $3310.Technical Outlook – 4-Hour Timeframe Gold prices are trading below the major support level around 3325, which was broken during the …

Read More »EUR Loses Momentum, Breaks Uptrend Line 20/8/2025

The EUR/USD pair has been dominated by a bearish trend after failing to close above the psychological resistance level of 1.1700.Technical Outlook – 4-Hour Timeframe:Technical indicators are signaling a negative bias. The 50-day Simple Moving Average (SMA) continues to exert downward pressure, supported by negative signals from the Relative Strength …

Read More »Bitcoin Sees Bold Corporate Purchases in a Flat Market

Bitcoin’s recent price action has been a test of patience, as the asset appears stuck in a tight trading range. This period of consolidation, however, is not deterring a new wave of corporate adopters who are placing significant bets on the long-term value of the cryptocurrency. This divergence between a …

Read More »S&P Debt Rating Explained: Are Trump’s Tariffs A Fiscal Lifeline in Turbulent Times?

Experts who have watched economic policies unfold over decades, find the latest affirmation from S&P Global Ratings both vindicating and thought-provoking. In a bold move that defies conventional wisdom, President Donald Trump’s tariffs are proving to be more than just trade bluster—they’re a strategic revenue engine helping stabilize America’s finances. …

Read More »Market Drivers – US Session: USD Gains Ground Ahead of FOMC Minutes

The US Dollar (USD) gained ground on Tuesday as market participants adopted a cautious stance ahead of several key events, including Wednesday’s release of the Federal Open Market Committee (FOMC) Minutes and the highly anticipated Jackson Hole Symposium later in the week. Heightened geopolitical tensions also contributed to the safe-haven …

Read More »Are Geopolitical Wins Enough to Boost Investor Confidence on Wall Street?

Wall Street kicked off the trading day with a mixed performance, as investors braced for a flurry of retail earnings reports and kept a close watch on developments in the ongoing Ukraine-Russia conflict. The major indices showed little decisive movement, reflecting a blend of caution and optimism in the face …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations