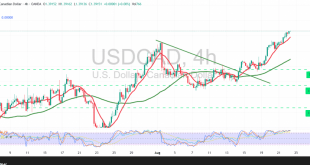

The USD/CAD pair has been gradually rising, following the expected positive outlook. It touched the first technical station at 1.3920 after reaching its highest level during the current session’s early trading at 1.3915. Technical Outlook – 4-Hour Timeframe The pair successfully broke the resistance level of 1.3880, which has now …

Read More »Technical Signals Suggest Continued Pressure on the Pound 22-8-2025

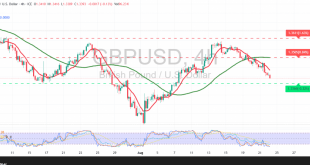

The GBP-USD pair successfully touched its first target of 1.3420 during the previous session, reaching its lowest level during today’s morning session at 1.3393. Technical Outlook – 4-Hour Timeframe The price’s continued stability below the Simple Moving Average increases the likelihood of extended selling pressure, especially with the clear negative …

Read More »Oil: WTI Corrects Overbought Conditions 22/08/2025

Futures prices for West Texas Intermediate (WTI) crude oil temporarily regained their upward trend during the previous session after clearly breaking the resistance level of 62.50, reaching a high of $63.64 per barrel. Technical Outlook – 4-Hour Timeframe Intraday movements show a downward bias as part of a natural corrective …

Read More »Gold at a Crossroads: Bullish Reversal or Extended Decline? 22-8-2025

Gold prices attempted a bullish rebound during the previous trading session, but gains remained limited after they hit the pivotal resistance level of 3355, which successfully curbed the upward momentum and stopped the positive thrust. Technical Outlook – 4-Hour Timeframe Intraday movements are trending downward, retesting the support level of …

Read More »The Shared Currency Under Pressure.. Will Euro Continue Its Downward Trend Against The Dollar? 22-8-2025

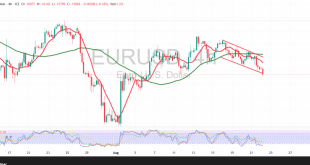

The Euro (EUR-USD) is resuming its downward movement against the US dollar, consistent with the expected decline mentioned in the previous technical report. Current price action is stable near the low of the morning session at 1.1583, just a few points away from the target of 1.1575. Technical Outlook – …

Read More »US Bond Yields Continue to Rise After Manufacturing Data

U.S. bond yields continued their ascent on Thursday, bolstered by recent statements from Federal Reserve officials and a series of unexpectedly positive economic reports. The yield on the benchmark 10-year Treasury note climbed to 4.330% from its previous close of 4.299%.This increase was fueled by comments from Beth Hammack, a …

Read More »Investors hit the brakes: Dow Jones tumbles amid rate cut fears

The Dow Jones Industrial Average fell to its lowest point in over a week on Thursday as investors grew cautious about the prospects for a Federal Reserve interest rate cut in September. While some positive economic data helped to limit losses, the market remains concerned that rising inflation—fueled by tariffs—could …

Read More »Jerome Powell’s Pivotal Address: Three Scenarios for the Market’s Next Move

As the financial world awaits Federal Reserve Chair Jerome Powell’s highly anticipated speech at the annual economic symposium this Friday, investors are holding their breath for clarity on the central bank’s stance regarding interest rates. Amid a backdrop of mixed economic signals—steady GDP growth despite a struggling labor market, and …

Read More »Gold’s Resilience Ahead of Jackson Hole: A Pivotal Moment for Monetary Policy

Gold prices have held firm amid mounting anticipation for the Federal Reserve’s Jackson Hole symposium, where Chair Jerome Powell is set to deliver a key speech on economic outlook and policy direction. As of Thursday, spot gold dipped slightly by 0.1% to $3,342.25 per ounce, while U.S. gold futures for …

Read More »Boeing Edges Closer to Historic Mega-Deal with China for 500 Jets Amid Trade Talks

Boeing is on the verge of sealing a monumental aircraft deal with China that could involve selling up to 500 planes, according to informed sources. If finalized, this agreement would end a prolonged freeze on sales that dates back to a high-level U.S. visit to Beijing in 2017.Negotiations between Boeing …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations