Oil prices displayed divergent trends in recent trading sessions, with West Texas Intermediate holding steady near $64.74 per barrel after a marginal decline of 0.02%, while Brent crude advanced 0.60% to close at $68.19 per barrel. These movements come amid a backdrop of fluctuating demand signals and supply concerns, as …

Read More »This Week: Fed’s Shift in Tone on Interest Rates Upends Markets

As of today, Monday, August 25, 2025, markets are waking up to a new and completely different landscape from the beginning of last week’s trading. The final week, which concluded on August 22, 2025, was a complex work of art on which the U.S. Dollar’s (USD) movements charted a path …

Read More »Gold Surges Above $3,370 as Powell Signals Dovish Shift, Markets Eye September Rate Cut

Gold prices rallied on Friday, climbing above $3,370 after Federal Reserve Chair Jerome Powell struck a more dovish tone at Jackson Hole. Powell warned that risks to the labor market are mounting, even as inflation pressures remain tilted to the upside—an acknowledgment of the Fed’s increasingly delicate balancing act.The yellow …

Read More »Wall Street Soars Over 1,000 Points as Powell Hints at Rate Cuts in Jackson Hole

U.S. stocks staged a sharp rebound on Friday, snapping a two-day losing streak, after Federal Reserve Chair Jerome Powell signaled the central bank may be preparing to cut interest rates.The Dow Jones Industrial Average jumped nearly 1,000 points, or 2.2%, to close at 43,744. The Nasdaq 100, driven by heavyweight …

Read More »Loonie Soars as Powell Turns Dovish: USD/CAD Slides Below 1.3840

The Canadian dollar gained ground on Friday, sending USD/CAD lower by nearly half a percent, as dovish signals from Federal Reserve Chair Jerome Powell and upbeat Canadian retail sales data combined to pressure the greenback. The pair slipped 0.49% to 1.3835 in North American trading, retreating from an earlier daily …

Read More »Yen Soars as Powell’s Remarks Spur Rate Cut Bets

The Japanese yen advanced sharply against the US dollar on Friday, as Federal Reserve Chair Jerome Powell’s remarks at the Jackson Hole Symposium fueled speculation of an impending rate cut. The USD/JPY pair retreated from a three-week high of 148.78 to trade near 146.66, marking a near 1% drop and …

Read More »Powell Hints at Imminent Rate Cuts as Trump’s Pressure on the Fed Intensifies

Federal Reserve Chair Jerome Powell has signaled that long-awaited interest rate cuts could arrive soon, marking the first such move during the current presidential term. In a pivotal speech at a major central banking forum, Powell highlighted growing concerns over a weakening job market, suggesting that lower rates might be …

Read More »Dow Jones Hits Resistance, Eyes on Jackson Hole 22-8-2025

The Dow Jones Industrial Average (DJI30) saw mixed movements with a downward bias during the previous session after recording a high of 45004. Technical Outlook – 4-Hour Timeframe Technically, the 50-day Simple Moving Average has returned to exert pressure on the price from above. This is accompanied by negative signals …

Read More »The Bullish Scenario Dominates the Loonie’s Movements 22-8-2025

The USD/CAD pair has been gradually rising, following the expected positive outlook. It touched the first technical station at 1.3920 after reaching its highest level during the current session’s early trading at 1.3915. Technical Outlook – 4-Hour Timeframe The pair successfully broke the resistance level of 1.3880, which has now …

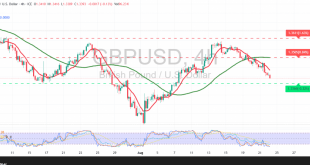

Read More »Technical Signals Suggest Continued Pressure on the Pound 22-8-2025

The GBP-USD pair successfully touched its first target of 1.3420 during the previous session, reaching its lowest level during today’s morning session at 1.3393. Technical Outlook – 4-Hour Timeframe The price’s continued stability below the Simple Moving Average increases the likelihood of extended selling pressure, especially with the clear negative …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations