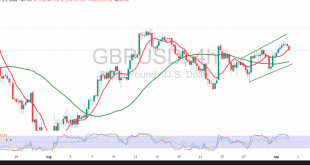

The GBP/USD pair posted strong gains in the first trading session of the week, supported by weakness in the US dollar, and reached a new high near the 1.3550 target. Technical Outlook – 4-hour timeframe: Intraday price action is showing a mild bearish bias as a result of profit-taking following …

Read More »Oil Defies Selling Pressure! 2/09/2025

US WTI crude oil futures recorded strong gains after successfully building a base above the psychological support at $63.00, climbing to a high of $65.05 per barrel. Technical Outlook – 4-hour timeframe: The price is trading within an upward corrective channel, supported by its stability above a well-defined ascending trend …

Read More »Gold Takes Center Stage: What’s Ahead? 2/9/2025

Gold prices (XAU/USD) extended their rally in early trading of the current session, surpassing the previous target at 3,505 and recording a new high at 3,508, reflecting the persistence of strong bullish momentum. Technical Outlook – 4-hour timeframe: The broader trend remains bullish, supported by price action along the ascending …

Read More »Euro Tests Critical Resistance… Technical Signals to Define the Next Path 2/9/2025

The EUR/USD pair started the week’s trading with a bullish bias, climbing to 1.1736 after breaking through the psychological resistance at 1.1700. Technical Outlook – 4-hour timeframe: Despite minor intraday pullbacks, the 50-period simple moving average continues to support the upward trend. The Relative Strength Index (RSI) is showing signs …

Read More »Bitcoin Slips to Two-Month Low as Traders Eye U.S. Jobs Data and ETF Outflows

Bitcoin extended losses on Monday, sliding to its weakest level in two months as heavy whale selling, soft ETF flows, and broader risk-off sentiment weighed on the crypto market. Bitcoin Hits Fresh Two-Month Low The world’s largest cryptocurrency dropped 0.8% to $107,994.6 by 02:42 ET (06:42 GMT). It earlier touched …

Read More »European Stocks Rise as Novo Nordisk Boosts Healthcare Sector, Defense Shares Advance

European equities edged higher on Monday, supported by strength in the healthcare sector after Novo Nordisk shares gained on positive drug data, while defense stocks also advanced on a new U.K.-Norway deal. Healthcare Stocks Drive Gains The pan-European Stoxx 600 rose 0.4%, buoyed by a 2.8% jump in Novo Nordisk …

Read More »Dollar Slips Ahead of Key U.S. Jobs Data; Fed Independence Concerns Linger

The U.S. dollar weakened on Monday as investors turned their attention to a busy week of labor market data that could determine the size of an anticipated Federal Reserve rate cut later this month. Dollar Under Pressure The dollar eased 0.04% against the yen to 146.98, extending a 2.5% monthly …

Read More »Gold Extends Rally to Four-Month High as Rate Cut Bets and Safe-Haven Demand Rise

Gold prices climbed to their highest level since mid-April in Asian trading on Monday, driven by strong expectations of a September Federal Reserve rate cut and heightened safe-haven demand amid Fed independence concerns and tariff-related uncertainty. Spot Gold: $3,480.56/oz (+0.9%) Gold Futures (December): $3,551.82/oz (+1%) August performance: Nearly +5%, marking …

Read More »Oil Prices Fall as Supply Fears Ease, Demand Outlook in Focus

Oil prices slipped in Asian trading on Monday, extending last month’s losses as traders discounted the likelihood of immediate supply disruptions from potential secondary sanctions on Russian crude and instead focused on Chinese factory data for demand cues. Brent October futures: $67.21 (-0.4%) WTI crude futures: $63.78 (-0.4%) August performance: …

Read More »U.S. PCE Inflation Holds Steady in July, Core Gauge Edges Higher

The U.S. Bureau of Economic Analysis (BEA) reported Friday that annual inflation, measured by the Personal Consumption Expenditures (PCE) Price Index, remained at 2.6% in July, in line with market expectations. Core PCE Inflation Core PCE, which strips out volatile food and energy prices, rose to 2.9%, slightly higher than …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations