Oil prices fell by four dollars a barrel on Monday, falling below $100 a barrel, after countries announced plans to withdraw record amounts of crude and oil products from their strategic stocks and with continued shutdowns in China. Brent crude fell $3.93, or 3.8 percent, to $98.58 a barrel by …

Read More »Palladium jumps 5% on supply concerns, inflation risks lift gold prices

On Monday, palladium prices jumped 5 percent to their highest level in more than two weeks, driven by supply concerns after trading of the metal was suspended from Russia, while gold prices increased due to inflation tension caused by the war in Ukraine. Palladium rose 4.5 percent to $ 2534.40 …

Read More »The Russian oil embargo may be part of the next EU sanctions package

The Russian oil embargo may be part of the The European Commission, the European Union’s executive arm, is preparing proposals for an EU embargo on Russian oil, the foreign ministers of Ireland, Lithuania and the Netherlands said on Monday, although there is no agreement yet. Referring to the commission, Irish …

Read More »Ukraine can export 600,000 tons of grain and oilseeds per month

With the Black Sea ports closed, Ukraine can export 600,000 tons of grain and oilseeds per month, but may increase its export capacity to 2 million tons, the Ukrainian Grain Traders Union (UGA) said on Monday. Ukraine used to export almost all of its grains and oilseeds through seaports but …

Read More »The Euro Begins to Recover

The euro appeared to be on its way on Monday to end a seven-day losing streak against the dollar, as the European single currency rallied after French President Emmanuel Macron defeated far-right rival Marine Le Pen in the first round of the presidential election. Investors’ concern about the future trends …

Read More »UK: Real GDP Grows by 0.1% in February

The data published by the UK’s Office for National Statistics showed on Monday that the real Gross Domestic Product grew by 0.1% on a monthly basis in February. This print followed January’s expansion of 0.8% and missed the market expectation of 0.3%. Other data from the UK revealed that the …

Read More »Japan’s Nikkei closed lower, technology stocks affected by Nasdaq

Japan’s Nikkei closed lower on Monday, as technology stocks followed the Nasdaq’s decline, which was affected by the Federal Reserve’s (US Central Bank) strong move to tackle inflation. The Nikkei index fell 0.61 percent to close at 2,6821.52 points after it had been trading higher earlier in the session. The …

Read More »Oil is falling due to fears of the closure in China

Oil prices fell more than $2 a barrel on Monday, following a second consecutive weekly decline after countries announced plans to withdraw record amounts of crude and petroleum products from their strategic stocks and as lockdowns continued in China. Brent crude fell $2.05, or 2.0 percent, to $100.73 a barrel …

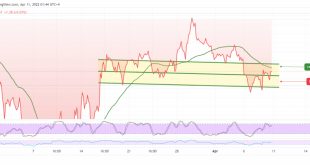

Read More »German Dax is Looking for Signals 11/4/2022

Oil, Crude, trading

Read More »The Dow Jones is back for gains 11/4/2022

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations