The data published by the UK’s Office for National Statistics showed on Monday that the real Gross Domestic Product grew by 0.1% on a monthly basis in February. This print followed January’s expansion of 0.8% and missed the market expectation of 0.3%. Other data from the UK revealed that the …

Read More »Japan’s Nikkei closed lower, technology stocks affected by Nasdaq

Japan’s Nikkei closed lower on Monday, as technology stocks followed the Nasdaq’s decline, which was affected by the Federal Reserve’s (US Central Bank) strong move to tackle inflation. The Nikkei index fell 0.61 percent to close at 2,6821.52 points after it had been trading higher earlier in the session. The …

Read More »Oil is falling due to fears of the closure in China

Oil prices fell more than $2 a barrel on Monday, following a second consecutive weekly decline after countries announced plans to withdraw record amounts of crude and petroleum products from their strategic stocks and as lockdowns continued in China. Brent crude fell $2.05, or 2.0 percent, to $100.73 a barrel …

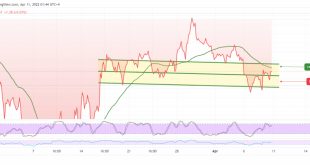

Read More »German Dax is Looking for Signals 11/4/2022

Oil, Crude, trading

Read More »The Dow Jones is back for gains 11/4/2022

Oil, Crude, trading

Read More »CAD facing negative pressure 11/4/2022

There were positive attempts by the Canadian dollar to achieve the expected bullish rebound at the end of last week’s trading, recording its highest level around the psychological resistance level of 1.2600. Technically, the pair’s current movements are witnessing a bearish tendency as a result of the negativity features that …

Read More »GBP trying to bounce back 11/4/2022

Oil, Crude, trading

Read More »Gold breaks out of the sideways range 11/4/2022

After several consecutive sessions of our commitment to neutrality, waiting for the gold price to exit the sideways range between 1925 and 1940, explaining that activating purchase orders depends on gold’s ability to penetrate 1940 to target 1948, recording its highest price last Friday’s transactions 1948. From the angle of …

Read More »Euro May Retest Resistance 11/4/2022

The euro continues its negative movements against the US dollar within the expected bearish context, approaching the target during the last analysis, at 1.0820, recording the lowest level at 1.0836. Technically today, and by looking at the 4-hour chart, we notice the continuation of the movement below the 50-day moving …

Read More »Canadian Economy adds 72.5K jobs in March

The Canadian economy added 72,500 jobs in March, a tad below the median economist forecast for 80,000 jobs to have been added on the month, a report released by Statistics Canada on Friday showed. That marked a significant deceleration in the pace of job gains versus February when 336,600 jobs …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations