Oil, Crude, trading

Read More »GBP/JPY: Building on Support 19/5/2022

The British pound declined noticeably yesterday, within the scenario of retesting the support, as we expected, touching the official target station at 159.20, recording its lowest level at 157.90. Technically, and with careful consideration of the 4-hour chart, the pair found a strong support floor around 158.50, which forced it …

Read More »CAD is facing negative pressure 19/5/2022

Mixed trades dominated the movements of the Canadian dollar during the last session’s trading to succeed in retesting the resistance level required to be touched during the previous analysis at 1.2895, recording its highest level at 1.2895. Technically, the 50-day simple moving average started to pressure the price from above, …

Read More »GBP in favor of the downtrend 19/5/2022

Oil, Crude, trading

Read More »Gold maintains negative technical conditions 19/5/2022

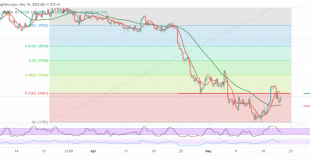

Gold prices maintained negative stability within the expected bearish context during the previous analysis after finding a strong resistance level around 1827, which forced the price to trade negatively again, maintaining the same technical conditions of the last report. On the technical side, the current moves of gold are witnessing …

Read More »The euro is waiting for a price destination to be determined 19/5/2022

The support levels published during the previous report at 1.0460, managed to limit the bearish bias, as the euro successfully retested the mentioned level, trying to maintain stability above the resistance level of the psychological barrier of 1.0500. Technically today, and by carefully looking at the 240-minutes, we notice the …

Read More »US: Housing starts fell by 0.2% in April, Building Permits fell by 3.2%

Housing Starts in the US fell 0.2% in April to 1.724M, below last month’s 1.728M and expectations for a rise to 1.765M. Building Permits, meanwhile, fell from 1.879M in March to 1.819M in April, a drop of 3.2%. That was above the expected drop to 1.812M.

Read More »Canada: Annual CPI rises to 6.8% in April

The pace of annual inflation in Canada according to the Consumer Price Index (CPI) rose to 6.8% in April, data released by Statistics Canada on Wednesday showed. That was slightly above expectations for a YoY rate of CPI to come in unchanged from March at 6.7% in April. MoM, prices …

Read More »Moscow: Possible tariffs on Russian oil will force buyers to pay more

A US proposal to impose tariffs on Russian oil means buyers will have to pay more or look for alternative suppliers, Kremlin spokesman Dmitry Peskov said on Wednesday, May 18. And US Treasury Secretary Janet Yellen said on Tuesday, May 17, that the European Union could combine imposing tariffs on …

Read More »Gold is near its lowest level in 3 and a half months

On Wednesday, gold prices settled near their lowest levels since late January, under pressure from the recovery of the dollar and the hawkish stance of the Federal Reserve Chairman on inflation. By 0831 GMT, gold recorded in spot transactions 1815.39 dollars an ounce. And US gold futures fell 0.2 percent …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations