U.S. stock index futures traded in a muted fashion on Tuesday, pausing after Wall Street logged a three-day winning streak and fresh record highs. At 05:55 ET (09:55 GMT), Dow Jones Futures added 85 points, or 0.2%, S&P 500 Futures edged up 1 point, or 0.1%, and Nasdaq 100 Futures …

Read More »Bitcoin Holds Steady After $1.5 Billion Derivatives Shakeout

Bitcoin traded largely unchanged on Tuesday, extending pressure from a massive $1.5 billion wipe-out in crypto derivatives a day earlier, while investors braced for fresh volatility tied to one of the largest ever options expiries. Crypto Sell-Off Wipes Out Leverage The world’s biggest cryptocurrency last slipped 0.1% to $112,711.6 as …

Read More »Gold Pushes to Fresh Record Highs Amid Fed Uncertainty

Gold prices climbed to new records in Asian trading on Tuesday, supported by safe-haven demand as cautious comments from Federal Reserve officials tempered expectations for aggressive interest rate cuts. Haven Flows Drive Gold Higher Spot gold surged to an all-time high of $3,759.18/oz, while gold futures touched $3,794.82/oz. Risk aversion …

Read More »Dow Jones Hits Initial Upside Goal 23/9/2025

The index succeeded in achieving the first bullish target outlined in the previous report at 46,635, recording a session high of 46,784. Technical Outlook: 50-period Simple Moving Average (SMA): Continues to support the price from below, acting as dynamic support and reinforcing the bullish outlook. Relative Strength Index (RSI): Showing …

Read More »CAD May Extend Its Gains 23/9/2025

The pair continues to move within an overall upward trajectory, though technical signals remain conflicting. Technical Outlook: Relative Strength Index (RSI): Beginning to show negative signals on the short-term timeframe, hinting at a possible slowdown in momentum. Simple Moving Averages (SMA): Acting as dynamic support, helping to maintain the broader …

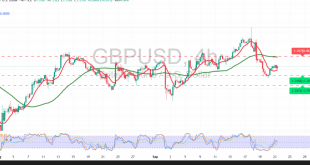

Read More »GBP Challenges Major Resistance Point 23/9/2025

The pair witnessed mixed trading with a slight bullish bias after establishing a short-term support line. Technical Outlook: Relative Strength Index (RSI): Showing negative signals due to overbought conditions relative to price action, raising the risk of negative divergence. 50-Period Simple Moving Average (SMA): Acting as dynamic resistance, maintaining downward …

Read More »Heavy Selling Pressure Drags Oil Lower 23/9/2025

WTI crude extended its bearish trajectory, reaching the first target at $62.15 before recording a session low of $61.65, now approaching the next stop at $61.30. Technical Outlook: Simple Moving Averages (SMA): Prices remain under pressure from above, with moving averages forming dynamic resistance that limits rebound attempts. Relative Strength …

Read More »Gold Hits Fresh Highs — Is $3,800 Next? 23/9/2025

Gold extended its rally during the European session, recording a high of $3,759 per ounce, surpassing the previously mentioned $3,720 resistance. Technical Outlook: Simple Moving Averages (SMA): Price action remains supported above the moving averages, which act as dynamic support reinforcing the bullish structure. Relative Strength Index (RSI): Approaching overbought …

Read More »Euro Faces Overbought Pressure — Will a Pullback Begin? 23/9/2025

The pair temporarily reversed the expected outlook from the previous report. While we anticipated stability below 1.1770, a breakout above this resistance and consolidation pushed the price to 1.1819. Technical Outlook: 50-Day Simple Moving Average (SMA): Continues to provide dynamic support, maintaining the overall bullish structure. Relative Strength Index (RSI): …

Read More »Dollar Struggles as Fed Caution Tempers Rate-Cut Bets

The U.S. dollar faced renewed pressure in Asian trading on Tuesday as investors digested a mix of hawkish and dovish signals from Federal Reserve officials ahead of key inflation data later this week. The dollar index steadied at 97.326, after snapping a three-day winning streak on Monday. Fed Caution Keeps …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations