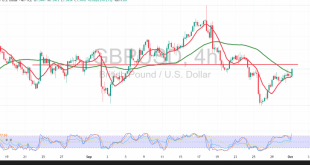

The pair is trading with a slightly positive intraday bias but remains capped below the key resistance level of 1.3480, keeping the overall pressure tilted to the downside. Technical Outlook: RSI: Showing early negative signs after entering overbought territory, hinting at potential negative divergence and weakening upside momentum. 50-period SMA: …

Read More »Oil Strives to Recover Losses 1/10/2025

WTI crude oil successfully reached the downside target highlighted in the previous report at $62.20, recording a low of $62.00 per barrel. Technical Outlook: Moving Averages: Prices remain pressured from above, with dynamic resistance forming near $63.15, limiting recovery attempts. RSI: Hovering near oversold territory, the indicator is beginning to …

Read More »Gold Recovers Momentum Post-Correction: Another High in Sight? 1/10/2025

Gold successfully completed the corrective decline highlighted in the previous report, reaching $3,793, before resuming its upward trajectory and recording a new session high at $3,875 in early trading today. Technical Outlook: Trend: The overall bias remains bullish after the completion of the initial correction wave. 50-period SMA: Price continues …

Read More »Euro Faces Dollar Headwinds 1/10/2025

The pair continues to trade in a narrow sideways range with a cautious upward bias. Technical Outlook: 50-day Simple Moving Average (SMA): Price remains capped below this level, reducing the probability of sustained upside movement. Relative Strength Index (RSI): Now in overbought territory, signaling weakening momentum and the potential for …

Read More »U.S. Stock Futures Slip as Shutdown Risks and Tariffs Weigh on Sentiment

U.S. stock index futures edged lower on Tuesday, as investors weighed the growing likelihood of a government shutdown and a fresh wave of trade tariffs, while also positioning ahead of the release of key labor market data. At 06:10 ET (10:10 GMT), Dow Jones Futures slipped 110 points, or 0.2%, …

Read More »Washington Braces for Looming Shutdown as Partisan Divide Widens

The U.S. government is on the brink of a shutdown, with funding set to expire at midnight Tuesday (0400 GMT Wednesday) unless lawmakers in Congress strike a last-minute deal. Partisan Gridlock Over Healthcare and Spending The Republican-controlled Senate is expected to hold another vote on a stopgap funding bill, but …

Read More »European Stocks Edge Lower Amid Tariff Concerns and Shutdown Risks

European markets traded cautiously on Tuesday, weighed down by fresh U.S. tariffs and fears of a looming government shutdown in Washington. At 07:02 GMT, Germany’s DAX slipped 0.2%, France’s CAC 40 dropped 0.2%, while the U.K.’s FTSE 100 managed a 0.1% gain. Trump’s Tariff Escalation Adds to Global Growth Worries …

Read More »Oil Prices Slide on Anticipated OPEC+ Hike and Kurdish Export Resumption

Oil prices extended their decline on Tuesday, pressured by expectations of rising supply as OPEC+ prepares for another production increase and exports from Iraq’s Kurdistan region resumed through Turkey, reinforcing concerns of a looming surplus. By 08:09 GMT, Brent crude futures for November delivery, expiring today, dropped 1.2% to $67.13 …

Read More »German Joblessness Rises Above 3 Million as Economic Weakness Persists

Germany’s labor market showed renewed signs of strain in September, with unemployment rising more than expected, underscoring the challenges facing Europe’s largest economy as it grapples with its steepest downturn in decades. According to data released by the Federal Labour Office on Tuesday, the number of unemployed people rose by …

Read More »Dow Jones Loses Momentum Temporarily 30/9/2025

The index recorded notable gains in the previous session, reaching a high of 46,787. Technical Outlook: 50-period Simple Moving Average (SMA): Continues to support the price from below, reinforcing the broader bullish structure. Relative Strength Index (RSI): Entering overbought territory and beginning to send negative signals, indicating short-term momentum may …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations