The pair maintained its bullish momentum, reaching the official target at 1.3970 and recording a session high of 1.3986. Technical Outlook: RSI: Continues to issue positive short-term signals, reflecting sustained bullish momentum. 50-day SMA: Price action remains above the moving average, providing dynamic support to the uptrend. Probable Scenario: Bullish …

Read More »Pound Gives Up Its Gains 3/10/2025

The pair extended its bearish trajectory in line with expectations, reaching the first downside target at 1.3430 and printing a session low of 1.3401. Technical Outlook: RSI: Cleared the oversold zone from the prior session but continues to show weak momentum, reflecting limited buying strength. 50-day SMA: Still acting as …

Read More »Oil Suffers Heavy Losses 3/10/2025

US crude oil futures faced heavy selling pressure in the last session, sliding to a low of $60.42 per barrel. Technical Outlook: Moving Averages: The simple moving averages continue to weigh on price from above, with the 50-day SMA converging near 61.80, reinforcing resistance. RSI: The index is in oversold …

Read More »Spotlight on Gold: Profit Booking or Structural Decline? 3/10/2025

After reaching a record high of $3,897, gold prices faced heavy profit-taking, retreating to $3,819 before attempting to stabilize. Technical Outlook: 50-day SMA: Price action remains supported above the moving average, preserving the broader bullish structure. RSI: Currently sending negative signals, reflecting weaker momentum and creating intraday volatility. Trend Bias: …

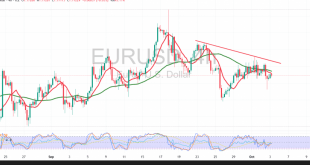

Read More »Below the Downtrend Line: Where Is EUR/USD Heading? 3/10/2025

The pair moved lower in line with the previous bearish outlook, approaching the first downside target at 1.1665 and recording a low of 1.1683. Technical Outlook: 50-day SMA: Price action remains capped below the moving average, which acts as dynamic resistance, limiting upside potential. RSI: After a brief intraday rise, …

Read More »U.S. Futures Hold Near Records as Shutdown Fails to Shake Rate-Cut Bets

U.S. stock index futures steadied on Thursday near record highs, with investors shrugging off the start of a federal government shutdown and focusing instead on the likelihood of further Federal Reserve rate cuts this year. At 05:45 ET (09:45 GMT), Dow Jones Futures were little changed, while S&P 500 Futures …

Read More »Italy’s Unemployment Rate Rises to 6.0% in August, Youth Joblessness Climbs Sharply

Italy’s unemployment rate edged higher in August, with official data showing signs of weakness in the labor market despite analysts having expected a slight uptick. Figures from national statistics bureau ISTAT released Thursday showed the seasonally adjusted jobless rate rose to 6.0%, up from a downwardly revised 5.9% in July. …

Read More »Gold Holds Near Record Highs as U.S. Shutdown Stalls Data, Rate Cut Bets Rise

Gold prices hovered close to all-time highs in Asian trading on Thursday, as investors sought safety amid an ongoing U.S. government shutdown and rising confidence that the Federal Reserve will deliver further interest rate cuts. Spot gold was steady at $3,864.63 an ounce by 00:45 ET (04:45 GMT), after touching …

Read More »Bitcoin Jumps to Seven-Week High on Uptober Optimism, U.S. Shutdown Liquidity Hopes

Bitcoin surged to a seven-week high on Thursday, lifted by seasonal “Uptober” momentum and expectations that the ongoing U.S. government shutdown could inject fresh liquidity into crypto markets. The world’s largest cryptocurrency rose 3.7% to $118,481.5 by 02:10 ET (06:10 GMT), briefly breaking above $119,000 for the first time since …

Read More »Oil Prices Edge Higher After Hitting Four-Month Lows; OPEC+ Meeting in Focus

Oil prices steadied in Asian trade on Thursday, recovering slightly after sliding to near four-month lows in the previous session as rising U.S. crude inventories and speculation of another OPEC+ supply hike weighed heavily on sentiment. Market PerformanceAs of 21:52 ET (01:52 GMT), Brent crude futures (December delivery) rose 0.5% …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations