Oil prices gained ground on Monday after the OPEC+ alliance confirmed a smaller-than-expected production increase for November, easing fears of an aggressive supply expansion while a sluggish demand outlook continues to cap upside momentum. By 11:07 GMT, Brent crude futures climbed $0.89, or 1.4%, to $65.42 per barrel, while U.S. …

Read More »European Stocks Retreat as French Political Turmoil Hits Markets

European equities slipped on Monday, with French shares leading losses after newly appointed Prime Minister Sébastien Lecornu abruptly resigned, triggering renewed political uncertainty across the euro zone. By 09:46 GMT, the pan-European STOXX 600 index fell 0.2% to 569.4 points, retreating from an intraday record high reached earlier in the …

Read More »French Political Crisis Deepens as Lecornu Government Collapses Within Hours

France was plunged into fresh political turmoil on Monday after newly appointed Prime Minister Sébastien Lecornu and his government resigned only hours after unveiling their cabinet, marking the shortest-lived administration in modern French history. The shock resignation came barely 14 hours after Lecornu announced his ministerial team, sending the euro …

Read More »Gold Hits Record High as Yen Weakens and U.S. Rate Cut Bets Rise

Gold prices surged to fresh record highs in early Asian trading on Monday, supported by a sharp weakening in the Japanese yen and persistent expectations of further U.S. rate cuts amid political and economic uncertainty in Washington. Spot gold climbed as much as 1% to $3,926.63 an ounce, while December …

Read More »Dow Jones Retests Support 6/10/2025

The Dow Jones Industrial Average (DJI30) extended its bullish momentum, successfully reaching the target mentioned in the previous report at 47,140, and posting a new session high of 47,163. Technical Outlook – 4-Hour Timeframe: The 50-day Simple Moving Average (SMA) continues to act as dynamic support, reinforcing the broader bullish …

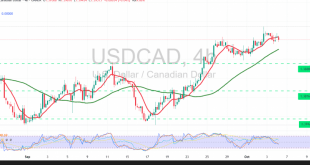

Read More »CAD Sustains Steady Climb 6/10/2025

The USD/CAD pair continues to show gradual upward movement, maintaining its recent bullish tone as technical indicators remain supportive of a continuation in the prevailing trend. Technical Outlook – 4-hour timeframe: The Relative Strength Index (RSI) continues to provide positive short-term signals, reflecting steady bullish momentum. Meanwhile, the price remains …

Read More »Pound Faces Downward Pressure 6/10/2025

The GBP/USD pair continues to trade under pressure on the intraday level, moving lower as it approaches the key psychological resistance at 1.3500. Technical Outlook – 4-hour timeframe: The Relative Strength Index (RSI) continues to issue negative signals, reflecting persistent bearish momentum on short-term timeframes. Meanwhile, the 50-day Simple Moving …

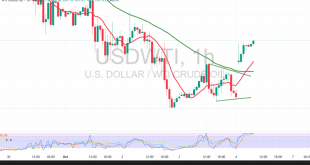

Read More »Oil Holds Above Resistance 6/10/2025

US crude oil futures (WTI) started the week with a bullish price gap, reaching a high of $61.88 per barrel. Technical Outlook – 4-hour timeframe: The price is attempting to consolidate above the $61.50 resistance level, supported by positive signals from the Relative Strength Index (RSI), despite entering overbought territory. …

Read More »Unstoppable Bullish Momentum — Is Gold Heading Toward $4,000? 6/10/2025

Gold prices continue to reach new record highs, starting the week with sharp gains during Asian trading, touching $3,933 per ounce. Technical Overview: 50-Day Simple Moving Average (SMA): The price remains firmly above this level, providing dynamic support that continues to strengthen the bullish momentum. Relative Strength Index (RSI): Despite …

Read More »Euro Steady Below Resistance 6/10/2025

The pair maintains its expected downward trajectory, having repeatedly failed to break the 1.1760 resistance level over several consecutive sessions. Technical Picture: 50-Day Simple Moving Average (SMA): The pair continues to trade below this level, which acts as dynamic resistance, limiting any further upside attempts. Relative Strength Index (RSI): Recently …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations