European equities traded higher on Wednesday, with France’s CAC 40 leading regional gains despite ongoing political instability in the country. The pan-European Stoxx 600 advanced 0.5%, while Germany’s DAX added 0.3%, and the UK’s FTSE 100 rose 0.3%. The CAC 40 climbed 0.8%, outperforming its peers even amid uncertainty following …

Read More »Oil Prices Rise as OPEC+ Decision Tempers Oversupply Concerns

Oil prices edged higher in early Wednesday trading as investors digested the OPEC+ decision to maintain a modest production increase for November, easing some fears of an oversupply-driven selloff. Brent crude rose 0.7% to $65.93 per barrel, while West Texas Intermediate (WTI) climbed 0.8% to $62.24 by 04:00 GMT. Both …

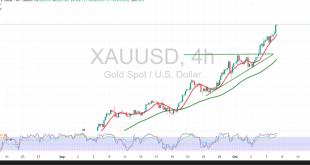

Read More »Gold Breaks $4,000 Barrier as Global Political Turmoil and Fed Cut Bets Drive Safe-Haven Surge

Gold prices soared past the $4,000-per-ounce mark for the first time in Asian trading on Wednesday, as investors flocked to safe-haven assets amid intensifying political instability in France and Japan and persistent economic uncertainty in the United States. Spot gold advanced 0.6% to a record $4,010.84/oz, while December gold futures …

Read More »Dow Jones Could Face Short-Term Pullback 8/10/2025

The Dow Jones Industrial Average (DJI30) saw mixed performance on Wall Street, retreating slightly after reaching a session high of 47,136, as investors booked profits following the recent bullish rally. Despite the pullback, the broader trend remains upward. Technical Outlook – 4-Hour Timeframe: The 50-day Simple Moving Average (SMA) continues …

Read More »CAD Poised for Further Gains 8/10/2025

The USD/CAD pair extended its upward movement for a second consecutive session, maintaining positive momentum in line with the previously expected bullish outlook. The pair continues to benefit from sustained demand for the US dollar and firm technical support. Technical Outlook – 4-Hour Timeframe: The Relative Strength Index (RSI) continues …

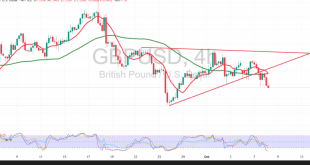

Read More »GBP/USD Breaks Key Support 8/10/2025

The GBP/USD pair extended its bearish movement in line with the previously expected outlook, successfully reaching the official downside target at 1.3390 amid sustained selling pressure and a firm strengthening of the US dollar. Technical Outlook – 4-Hour Timeframe: The Relative Strength Index (RSI) continues to generate negative signals despite …

Read More »Oil Regains Its Strength 8/10/2025

US WTI crude oil futures resumed an upward trajectory, attempting to recover losses from prior sessions after successfully establishing a solid support base near $60.80 per barrel. The move reflects renewed buying interest following a period of corrective pressure. Technical Outlook – 4-Hour Timeframe: The price is currently testing the …

Read More »Gold’s Rally Knows No Pause 8/10/2025

Gold (XAU/USD) continues to advance strongly, setting fresh all-time highs and reinforcing the prevailing bullish momentum. The metal reached a new record of $4,030 per ounce at the time of writing, driven by sustained buying activity and investor demand for safe-haven assets amid global uncertainty. Technical Outlook – 4-Hour Timeframe: …

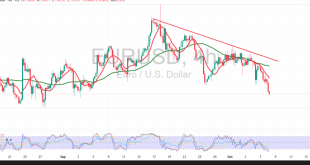

Read More »EUR/USD: Dollar Dominance Persists 8/10/2025

The EUR/USD pair extended its bearish trajectory in line with previous expectations, reaching the first downside target at 1.1645 and recording a new session low of 1.1619 during early trading. Technical Outlook – 4-hour timeframe: The broader trend remains decisively bearish, with the pair consistently trading below the 50-day Simple …

Read More »Yen Slides to Two-Month Low, Euro Weakens as Political Turmoil Grips Japan and France

Currency markets were dominated by political developments on Tuesday, with the Japanese yen falling to a two-month low following Sanae Takaichi’s victory in Japan’s ruling party leadership race, while the euro weakened further as France’s political crisis deepened after the resignation of its prime minister. Yen Drops as Takaichi Signals …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations