Bitcoin slipped slightly on Friday as traders took profits following its surge to all-time highs earlier in the week. While the world’s largest cryptocurrency remained buoyed by persistent optimism over U.S. rate cuts and seasonal “Uptober” enthusiasm, profit-taking and uncertainty surrounding the prolonged U.S. government shutdown tempered gains. Bitcoin declined …

Read More »U.S. Futures Inch Higher as AI Momentum, Consumer Sentiment Data Guide Market Mood

U.S. stock index futures edged slightly higher on Friday, signaling a rebound after Thursday’s pause, as investors refocused on the powerful artificial intelligence momentum that has underpinned markets throughout the year. Optimism around sustained AI-related investment, coupled with expectations of Federal Reserve rate cuts, continued to bolster market sentiment despite …

Read More »European Markets Open Flat as Investors Await Macron’s New Prime Minister Announcement

European stock markets opened broadly unchanged on Friday, with gains in banking and automobile shares offsetting weakness in the healthcare sector, as investors remained focused on political developments in France. The pan-European STOXX 600 index was steady at 571.2 points by 07:12 GMT, on track for its third consecutive weekly …

Read More »Gold Retreats as Investors Take Profits Following Ceasefire-Driven Shift in Risk Sentiment

Gold prices eased on Friday as investors engaged in profit-taking after the metal’s record-breaking rally earlier in the week. The announcement of a U.S.-brokered ceasefire between Israel and Hamas improved market sentiment, reducing demand for safe-haven assets and prompting a modest pullback across the precious metals sector. Spot gold fell …

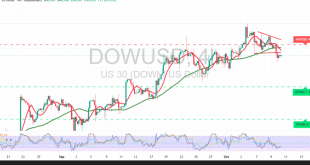

Read More »Dow Jones Faces Downward Pressure 10/10/2025

The Dow Jones Industrial Average declined during the previous Wall Street session after testing the 46,930 resistance level, which triggered renewed selling pressure and a shift toward negative price action. Technical Overview 50-Period Simple Moving Average (SMA): The index remains under pressure from the SMA, which continues to act as …

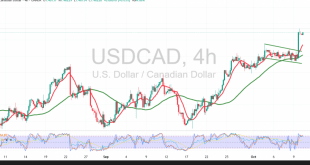

Read More »Canadian Dollar Extends Its Gains 10/10/2025

The USD/CAD pair extended its gradual upward movement, successfully breaching the key psychological resistance at 1.4000, reaching the target level of 1.4020 and marking an intraday high at 1.4034. Technical Overview The Relative Strength Index (RSI) continues to issue short-term positive signals, supporting the prevailing bullish momentum. Meanwhile, the pair …

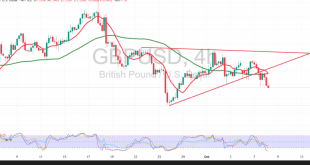

Read More »Pound Faces Selling Pressure 10/10/2025

The GBP/USD pair extended its sharp decline within the bearish framework highlighted in the previous report, breaking below the projected downside target at 1.3320 and recording a new low near 1.3280. Technical Overview Relative Strength Index (RSI): Despite entering oversold territory, the indicator continues to send negative signals, reflecting persistent …

Read More »Oil Breaks Out of the Ascending Channel 10/10/2025

U.S. WTI crude oil futures retreated after several consecutive sessions of gains, hitting a low near $61.30 per barrel during the previous session. Technical Overview The simple moving averages have turned into dynamic resistance levels, now exerting downward pressure on prices and likely limiting any recovery attempts. At the same …

Read More »Gold in Transition: Correction or Continuation? 10/10/2025

Gold prices retreated after reaching a new all-time high near $4,058 per ounce, as profit-taking prompted a pullback that pushed the metal to stabilize below the $4,000 psychological barrier. Technical Overview The metal found short-term support around $3,945, allowing a mild rebound toward $3,975. The simple moving averages continue to …

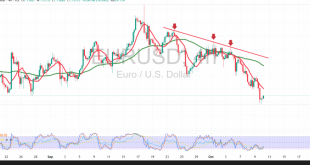

Read More »Euro May Extend Its Losses 10/10/2025

The EUR/USD pair remains under clear bearish pressure, consistent with our previous negative forecast. The pair has successfully reached the first downside target at 1.1555, recording a new low of 1.1542. Trend Overview The bearish trend continues to dominate as the price trades below the 50-period simple moving average (SMA), …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations