Gold prices surged to fresh all-time highs in Asian trading on Wednesday, extending a powerful multi-week rally as traders piled into safe-haven assets on expectations of imminent U.S. interest rate cuts and renewed U.S.-China trade frictions. Spot and Futures Prices Hit New Peaks Spot gold climbed 1.1% to $4,186.84 per …

Read More »Asian Stocks Rebound on Powell’s Dovish Remarks, but Trade Tensions Cap Gains

Asian markets bounced back on Wednesday, recovering from sharp losses earlier in the week as investors drew optimism from Federal Reserve Chair Jerome Powell’s dovish comments suggesting more potential rate cuts ahead. However, gains were tempered by persistent concerns over renewed U.S.-China trade tensions and signs of ongoing economic weakness …

Read More »IMF Raises 2025 Global Growth Outlook, Warns of Trade War Risks

The International Monetary Fund (IMF) raised its global growth forecast for 2025 to 3.2%, up from 3.0% in July, while keeping its 2026 projection steady at 3.1%, according to its World Economic Outlook report released Tuesday. Moderate Optimism Despite Trade Risks The IMF’s upward revision reflects more resilient financial conditions …

Read More »U.S. Stock Futures Decline as Trade Tensions Resurface and Investors Await Bank Earnings, Powell Speech

U.S. stock index futures moved lower on Tuesday, signaling a pause in the market’s recent rebound, as renewed concerns over the U.S.-China trade conflict and anticipation ahead of key bank earnings weighed on sentiment. Futures Turn Lower After Monday’s Recovery By 09:44 GMT, S&P 500 futures fell 0.8% (–55 points), …

Read More »European Stocks Slide as Trade Tensions and French Political Risks Weigh on Sentiment

European equities turned lower on Tuesday, with markets struggling to shake off renewed fears of a U.S.-China trade war and ongoing political turbulence in France. The decline came despite a brief rebound in the prior session, as traders reassessed global risk appetite. Broad-Based Losses Across Europe By 08:15 GMT, the …

Read More »Bitcoin Retreats as U.S.-China Trade Tensions Trigger Renewed Risk Aversion

Bitcoin extended its slide on Tuesday, cutting short a brief rebound as escalating tensions between Washington and Beijing reignited global risk aversion, prompting traders to rotate out of crypto assets and into traditional havens like gold. Bitcoin Pulls Back After Record Rally The world’s largest cryptocurrency fell 1% to $113,547.0 …

Read More »UK Wage Growth Slows to Two-Year Low, Strengthening Case for Early BoE Rate Cut

British wage growth cooled to its weakest pace since mid-2022, while unemployment ticked higher, reinforcing expectations that the Bank of England (BoE) could deliver its first rate cut earlier than previously anticipated. Pay Growth Loses Momentum but Hiring Shows Signs of Stabilization Data from the Office for National Statistics (ONS) …

Read More »Gold Hits Record High Above $4,100 as U.S.-China Tensions Rekindle Haven Demand

Gold prices steadied in Asian trade on Tuesday after a dramatic surge to a new all-time high above $4,100 per ounce, as renewed friction between the United States and China triggered a sharp flight to safety. Silver also rallied to record levels before retreating amid profit-taking. Gold Holds Firm After …

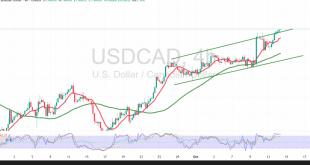

Read More »CAD Forms Solid Support 14/10/2025

The pair continues its gradual advance in line with our positive bias, edging toward the prior target after printing a session high at 1.4046. Technical Overview Momentum: The RSI maintains constructive short-term signals, consistent with ongoing bullish momentum. Trend filter: Price action remains above the 50-period SMA, reinforcing the prevailing …

Read More »Pound Steady Below Resistance 14/10/2025

The GBP/USD pair extended its decline within the bearish trend anticipated in the previous report, reaching a low of 1.3315 as selling pressure continued to dominate market sentiment. Technical Overview Relative Strength Index (RSI): The indicator continues to issue negative signals despite approaching oversold levels, confirming the strength and persistence …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations