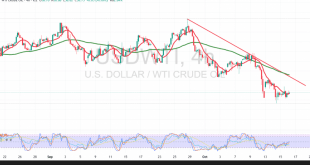

WTI crude (U.S. futures) met the prior report’s target at $58.70, printing a low of $58.22 before a modest rebound. The move appears corrective within a broader bearish structure. Technical:Price remains capped beneath down-sloping simple moving averages, which act as dynamic resistance and may limit upside attempts. RSI is trying …

Read More »Gold Prices Surge as Bullish Momentum Reignites 16/10/2025

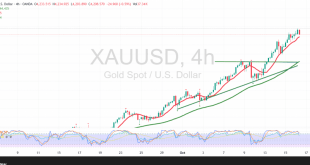

Gold (XAU/USD) extended its record-setting run in early trade, printing a new all-time high at $4,242/oz on firm safe-haven demand. Price action is holding above $4,155 and well above the $4,000 psychological pivot, confirming role-reversal support. Up-sloping simple moving averages keep bullish momentum intact, while RSI has cooled from overbought …

Read More »Double Bottom for the Euro — Is It Time to Rebound? 16/10/2025

The pair staged a clear rebound after breaking above 1.1630, prompting a short-term reversal of the bearish tone that dominated recent sessions. Technical Overview Trend context: While the broader structure remains bearish, price action is showing a bullish sub-trend intraday. SMAs: The simple moving averages have flipped to dynamic support, …

Read More »Bank of America Tops Q3 Estimates on Strong Loan Growth and Investment Banking Surge

Bank of America (NYSE: BAC) reported a stronger-than-expected third-quarter performance on Wednesday, buoyed by solid loan and deposit growth, a surge in investment banking activity, and higher interest income — signaling robust momentum across its core businesses despite a challenging macro backdrop. Earnings Beat Across Key Segments The U.S. banking …

Read More »U.S. Futures Rise as Powell’s Dovish Remarks Lift Sentiment; Earnings Season in Focus

U.S. stock index futures climbed on Wednesday, as investors cheered dovish comments from Federal Reserve Chair Jerome Powell and prepared for a fresh wave of corporate earnings reports, including major banks and United Airlines. Market Snapshot By 10:15 GMT (06:15 ET), Dow Jones Futures were up 215 points (+0.5%) S&P …

Read More »Bitcoin Steadies After Volatile Session as Rate-Cut Bets Counter Trade Tensions

Bitcoin stabilized on Wednesday, finding its footing after a turbulent few sessions marked by a clash of forces — renewed U.S.-China trade tensions and growing market conviction that the Federal Reserve will cut interest rates in October. Volatility Persists Amid Trade Uncertainty The world’s largest cryptocurrency was last down 0.2% …

Read More »European Stocks Edge Higher as French Politics and Trade Tensions Take Center Stage

European markets staged a cautious rebound on Wednesday, recovering slightly from the sharp losses seen earlier in the week as investors digested renewed U.S.-China trade frictions, a dovish tone from the Federal Reserve, and fresh political developments in France. Modest Recovery Across Major Indices By 07:10 GMT, the DAX in …

Read More »Gold Extends Record-Breaking Rally Amid Fed Easing Bets and Trade Tensions

Gold prices surged to fresh all-time highs in Asian trading on Wednesday, extending a powerful multi-week rally as traders piled into safe-haven assets on expectations of imminent U.S. interest rate cuts and renewed U.S.-China trade frictions. Spot and Futures Prices Hit New Peaks Spot gold climbed 1.1% to $4,186.84 per …

Read More »Asian Stocks Rebound on Powell’s Dovish Remarks, but Trade Tensions Cap Gains

Asian markets bounced back on Wednesday, recovering from sharp losses earlier in the week as investors drew optimism from Federal Reserve Chair Jerome Powell’s dovish comments suggesting more potential rate cuts ahead. However, gains were tempered by persistent concerns over renewed U.S.-China trade tensions and signs of ongoing economic weakness …

Read More »IMF Raises 2025 Global Growth Outlook, Warns of Trade War Risks

The International Monetary Fund (IMF) raised its global growth forecast for 2025 to 3.2%, up from 3.0% in July, while keeping its 2026 projection steady at 3.1%, according to its World Economic Outlook report released Tuesday. Moderate Optimism Despite Trade Risks The IMF’s upward revision reflects more resilient financial conditions …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations