European equities traded mostly lower on Wednesday, weighed down by fading hopes for a Ukraine peace deal and cautious corporate sentiment, though U.K. shares found some support from stable inflation data that may ease pressure on the Bank of England. At 07:05 GMT, Germany’s DAX slipped 0.2%, France’s CAC 40 …

Read More »U.K. Inflation Holds Steady in September, Offering Temporary Relief to BoE Policymakers

U.K. inflation remained unchanged in September, easing pressure on the Bank of England (BoE) ahead of its November policy meeting, although the rate still sits nearly double the central bank’s target. According to data from the Office for National Statistics (ONS), annual CPI rose 3.8%, matching readings from July and …

Read More »Dow Jones Posts Notable Gains 22/10/2025

The Dow Jones Industrial Average extended its advance, exceeding the prior target at 47,160 and printing a high at 47,355, keeping the near-term tone constructive. Technical:The 50-period SMA continues to provide a positive impulse, underpinning dips on the 4-hour chart. RSI is holding above the 50 midline, confirming short-term bullish …

Read More »CAD Breaches Key Support 22/10/2025

USD/CAD turned lower after failing at 1.4060, with price action slipping into negative trades and stabilizing around the 1.4000 pivot as sellers probe for follow-through. Technical:The pair broke its ascending support line, and simple moving averages have flipped to overhead resistance, reinforcing a near-term bearish tilt on the 4-hour chart …

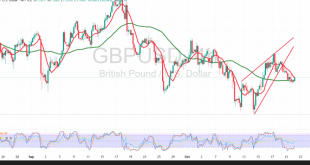

Read More »Pound Begins a Gradual Decline 22/10/2025

GBP/USD has been range-to-lower, fulfilling the 1.3360 target within the anticipated bearish trajectory. Technical:RSI continues to emit short-term negative signals. Intraday price action remains below the 1.3400 psychological barrier, keeping topside attempts constrained and preserving downside pressure. Base case (downside continuation):Bias stays lower while below 1.3400. A decisive break below …

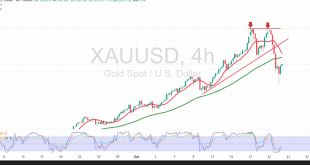

Read More »Freefall in Gold — Is This the Start of a Major Correction? 22/10/2025

Gold (XAU/USD) sold off sharply after failing to reclaim the $4,380 pivot, in line with the prior bearish bias. The drop forced a retest of $4,245 and extended to a $4,005 low before stabilizing. Technical:A clear double-top has formed, reinforcing short-term seller control. Price holds below down-sloping SMAs, which are …

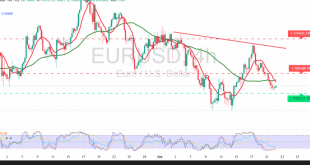

Read More »Negative Momentum Grips the Euro — Will Key Support Break? 22/10/2025

EUR/USD extended its decline last session, with sellers repeatedly pressuring the 1.1600 psychological floor amid a persistent short-term downtrend. Technical:Price is tracking a descending sub-channel and remains below the downtrend line, while simple moving averages cap rallies as dynamic resistance—all consistent with continued seller control. RSI is nearing oversold, which …

Read More »Canada’s Inflation Rises Slightly, Keeping Pressure on the Bank of Canada

Canada’s Consumer Price Index (CPI) edged higher in September, signaling a modest uptick in inflation and complicating the outlook for future monetary policy decisions by the Bank of Canada (BoC). According to Statistics Canada, the CPI rose 2.4% year-on-year, accelerating from 1.9% in August and slightly exceeding market expectations. On …

Read More »Oil Prices Edge Higher as Traders Weigh Oversupply Risks and Trade Outlook

Oil prices rebounded modestly on Tuesday, recovering from their sharp decline in the previous session as traders assessed signs of an oversupplied market and monitored ongoing developments in the U.S.–China trade dispute. At 10:19 GMT, Brent crude futures rose 52 cents, or 0.84%, to $61.52 a barrel, while U.S. West …

Read More »U.S. Futures Edge Lower Ahead of Heavy Earnings Slate, With Netflix in Focus

U.S. stock futures dipped slightly on Tuesday, pausing after recent gains as investors awaited a busy day of corporate earnings and monitored signs of progress on both the government shutdown and U.S.–China trade relations. By 05:55 ET (09:55 GMT), Dow Jones Futures were down 35 points (0.1%), S&P 500 Futures …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations