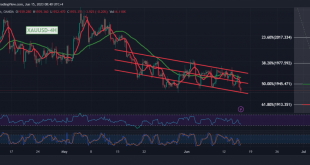

For several consecutive sessions during the current week’s trading, we have committed ourselves to remain neutral due to the movements of gold prices in a confined sideways price range, from the bottom above 1945 and from the top below 1977, explaining that the activation of selling positions begins with a …

Read More »Euro touches the target, eyes on ECB 15/6/2023

. Remarkable gains dominated the performance of the Dow Jones Industrial Average on Wall Street, within the positive outlook, as we expected, touching the official bullish target stations, reaching the last target of 34,130, recording its highest level of 34,112. Technically, we tend to be positive, relying on the index’s …

Read More »ECB Banks Preview: Forecast of 10 major banks

The European Central Bank (ECB) is poised to publish its monetary policy decision on Thursday, June 15 at 12:15 GMT, and as the day approaches, here are the expectations as anticipated by 10 major banks’ economists and researchers. The ECB is widely expected to give another 25 basis point (bps) …

Read More »IEA: Global oil demand will grow by 2.4 million bpd this year

The International Energy Agency (IEA) claimed in its latest oil market analysis, published on Wednesday, that “global oil demand will grow by 2.4 million bpd this year, to a record 102.3 million bpd.” The shift to a clean energy economy is picking up pace.A peak in global oil demand is …

Read More »US: Annual PPI rises 1.1% in May vs.1.5% expected

The Producer Price Index (PPI) for final demand in the United States grew 1.1% year on year in May, down from 2.3% in April, according to data released on Wednesday by the US Bureau of Labour Statistics. This number was lower than the 1.5% expected by the market. It is …

Read More »Stability of European stocks ahead of the US interest rate decision

European stocks opened flat on Wednesday ahead of the Federal Reserve’s widely expected decision to halt interest rate increases, while sports betting Entene shares tumbled after announcing a deal to buy another company. The European Stoxx 600 index settled at 463.49 points by 0709 GMT, while the travel and leisure …

Read More »Gold shines with the decline of USD

Gold prices rose on Wednesday, supported by a weaker dollar, as slowing US inflation boosted bets that the Federal Reserve will keep interest rates unchanged when it meets later in the day. And gold in instant transactions increased 0.3 percent to $ 1948.49 an ounce by 0500 GMT. US gold …

Read More »Dollar tends to decline amid increasing bets on Fed stopping rate hikes

On Wednesday, the dollar hovered near a three-week low against the euro and near a one-month low against the British pound, after lower-than-expected inflation data cemented the view that the Federal Reserve will refrain from raising interest rates this time when it makes its decision. later in the day. The …

Read More »The OPEC+ alliance gives Russia a higher base level of production

The OPEC+ alliance said on Tuesday that it had given Russia a higher base level for oil production after it agreed to work with a number of research institutions and agencies to revise its production figures. The Organization of the Petroleum Exporting Countries (OPEC) uses base levels related to oil …

Read More »Oil is stable as the market awaits US interest expectations

Oil prices rose slightly in Asian trading on Wednesday morning, as investors await the results of the Federal Reserve meeting for the month of June, key economic data from China and government data on US crude stocks. By 0340 GMT, Brent crude futures rose nine cents, or 0.1 percent, to …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations