The dollar rose in Asian trade on Thursday after the Federal Reserve signaled an interest rate hike later in the year, while the currencies of China and New Zealand fell amid signs of slowing economies. Market attention is now turning to other central banks’ decisions late this week. The dollar …

Read More »Dow Jones may witness a temporary decline 15/6/2023

Oil, Crude, trading

Read More »CAD loses momentum 15/6/2023

Trading tended to be negative, dominating the Canadian dollar’s movements within the expected bearish context, approaching by a few points away from the target to be achieved during the previous report at 1.3260, recording its lowest level at 1.3270. Technically, the current movements of the pair witness a limited bullish …

Read More »GBP may witness a temporary bearish correction 15/6/2023

Oil, Crude, trading

Read More »Oil hits resistance, negative pressure remains 15/6/2023

Crude oil futures prices declined significantly after failing to stabilize for a long time above the psychological barrier of $70.00, and the intraday movements are witnessing stability near its lowest level during the early trading of the current session, $97.95. Technically, with the continuation of moving below the simple moving …

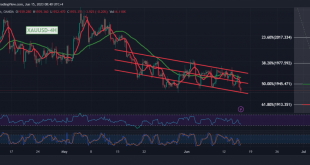

Read More »Gold breaks support and breaks out of the sideways range 15/6/2023

For several consecutive sessions during the current week’s trading, we have committed ourselves to remain neutral due to the movements of gold prices in a confined sideways price range, from the bottom above 1945 and from the top below 1977, explaining that the activation of selling positions begins with a …

Read More »Euro touches the target, eyes on ECB 15/6/2023

. Remarkable gains dominated the performance of the Dow Jones Industrial Average on Wall Street, within the positive outlook, as we expected, touching the official bullish target stations, reaching the last target of 34,130, recording its highest level of 34,112. Technically, we tend to be positive, relying on the index’s …

Read More »ECB Banks Preview: Forecast of 10 major banks

The European Central Bank (ECB) is poised to publish its monetary policy decision on Thursday, June 15 at 12:15 GMT, and as the day approaches, here are the expectations as anticipated by 10 major banks’ economists and researchers. The ECB is widely expected to give another 25 basis point (bps) …

Read More »IEA: Global oil demand will grow by 2.4 million bpd this year

The International Energy Agency (IEA) claimed in its latest oil market analysis, published on Wednesday, that “global oil demand will grow by 2.4 million bpd this year, to a record 102.3 million bpd.” The shift to a clean energy economy is picking up pace.A peak in global oil demand is …

Read More »US: Annual PPI rises 1.1% in May vs.1.5% expected

The Producer Price Index (PPI) for final demand in the United States grew 1.1% year on year in May, down from 2.3% in April, according to data released on Wednesday by the US Bureau of Labour Statistics. This number was lower than the 1.5% expected by the market. It is …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations