Oil, Crude, trading

Read More »Oil is trying to form a rising wave 2/1/2024

The most recent technical analysis report suggests that triggering selling positions hinges on breaking the 73.30 level, potentially initiating a downward trajectory for oil. In this scenario, the initial targets lie at 72.50, with the possibility of reaching its lowest point at $71.30 per barrel. From a technical standpoint, our …

Read More »Gold trying to maintain positive stability 2/1/2024

Gold prices are striving to maintain a positive stance as the first trading sessions of the week commence, successfully re-establishing stability above the crucial support level of 2065. From a technical analysis standpoint, a closer examination of the 4-hour chart reveals that the simple moving averages are reinforcing the upward …

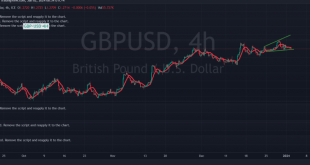

Read More »EUR facing negative pressure 2/1/2024

The upward trend continued to control the movements of the EUR/USD pair, as we expected, touching the official target required to be achieved during the previous technical report, located at the price of 1.1120, recording its highest level of 1.1122. On the technical side today, we are leaning towards positivity, …

Read More »Oil prices are set to end the year down 10 percent due to concerns about demand

As 2023 comes to a close, oil prices are poised to mark their first annual decline in two years, experiencing a roughly ten percent drop. Geopolitical concerns, production cuts, and global efforts to curb inflation have contributed to significant price fluctuations throughout the year. Current Oil Prices: Brent crude futures …

Read More »Bets for a rate cut in 2024 are pressuring USD to end the year on a losing note

As the year 2023 draws to a close, the US dollar faces the prospect of ending the year with a significant loss, erasing gains from two consecutive years. Market sentiment is shaped by expectations that the Federal Reserve may initiate interest rate cuts by March 2024, contributing to the dollar’s …

Read More »USD declines against JPY and compensates for its losses against EUR

The US dollar witnessed divergent movements against key currencies on Thursday, recovering from early losses against the euro while facing a decline against the Japanese yen. Investors are closely monitoring signals from the Federal Reserve, expecting a potential interest rate cut in the coming year. Dollar Index Performance: The dollar …

Read More »European stocks rise on expectations of interest rate cuts

European stocks showcased a positive trajectory on Thursday, led by gains in mining and insurance companies. The market outlook remained optimistic as the year neared its end, buoyed by expectations that major global central banks would potentially reduce borrowing costs in the coming year. Market Overview: The STOXX 600 index …

Read More »Oil Prices Rise Amid Middle East Tensions

Oil prices experienced an early uptick in Asian trading on Thursday, driven by persistent concerns over escalating tensions in the Middle East. These apprehensions overshadowed earlier worries about shipping traffic disruption, as some international shipping companies resumed activities in the Red Sea. Market Movement:Brent crude futures advanced by 0.3 percent, …

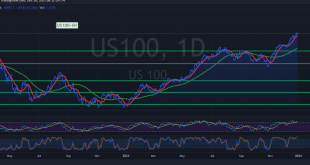

Read More »Nasdaq may achieve higher highs 28/12/2023

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations