For the second session in a row, levels of 2157 were able to limit the downward trend witnessed by gold prices, maintaining positive stability, and at the time of the report, it was trading around $2165 per ounce. From the angle of technical analysis today, by looking at the 4-hour …

Read More »Euro facing strong resistance 15/3/2024

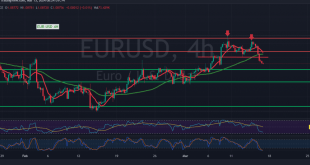

The euro continues its gradual ascent against the US dollar, maintaining consistent technical patterns for the third consecutive session. Analyzing the 240-minute timeframe chart, the simple moving averages persist in guiding the price from below, reinforcing the bullish technical structure evident on the chart. With daily trading sustained above the …

Read More »Eyes on Fed minutes and PPI

European markets experienced a notable upswing yesterday, reaching their highest levels in over a week. This occurred as financial markets adopted a more measured approach toward recent geopolitical events. Additionally, investors were contemplating the possibility of a stimulus plan in China and a subtle shift in tone from Fed policymakers …

Read More »US Producer Price Index (PPI) Exceeds Expectations

The latest data from the US Bureau of Labor Statistics revealed that the Producer Price Index (PPI) for final demand in the United States surged by 1.6% on a yearly basis in February. This figure surpassed market expectations of a 1.1% increase and marked a notable uptick from the 1% …

Read More »IEA Raises Oil Demand Growth Forecast Amidst Disruptions

The International Energy Agency (IEA) has revised its outlook for oil demand growth, citing disruptions to Red Sea shipping as a key factor. The agency, representing industrialized nations, forecasts a growth of 1.3 million barrels per day (bpd) in 2024, up by 110,000 bpd from its previous month’s projection. Divergent …

Read More »European Stocks Edge Higher Amid Data Anticipation

European stocks opened on a positive note on Thursday, buoyed by upbeat corporate reports, although investor sentiment remained cautious ahead of crucial economic data releases from the United States. The European STOXX 600 index, a barometer of regional market performance, edged 0.2 percent higher by 08:11 GMT, lingering near its …

Read More »Currency Markets Reflect Cautious Optimism Ahead of Awaited Data

Amidst a landscape of currency markets characterized by cautious optimism, investors around the globe find themselves on the precipice of pivotal decisions, with the trajectory of the world’s largest economy poised to influence exchange rates and trading sentiments. Data-Driven Anticipation The currency arena resonates with anticipation as market participants eagerly …

Read More »Nikkei Ends Higher on Thursday Amid Recovery in Chip Stocks, Energy Sector Boost

The Nikkei index in Japan closed higher on Thursday, rebounding from early losses as chip-related heavyweight stocks trimmed declines and energy stocks gained momentum. Market Performance The Nikkei closed up 0.29 percent at 38,807.38 points after enduring three consecutive sessions of losses. The index had initially fallen by as much …

Read More »Gold Prices Dip as Dollar Strengthens Ahead of Awaited Economic Data

Gold prices experienced a slight decline on Thursday as the dollar strengthened, although bullion remained near record highs. Traders were eagerly awaiting more US economic data, which could influence expectations regarding a potential mid-year interest rate cut. Price Movements By 0426 GMT, gold in spot transactions fell by 0.2 percent …

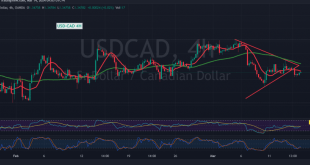

Read More »CAD maintains the downward trend 14/3/2024

The technical outlook remained unchanged, and there was no significant change in the pair’s movements, maintaining the bearish trend for the second session in a row, stable below the psychological barrier of 1.3500. From a technical analysis angle, we are leaning toward negativity, relying on the appearance of negative features …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations