Gold prices experienced a decline on Monday as the dollar strengthened, with investors eagerly anticipating the outcomes of forthcoming monetary policy meetings at major central banks, notably the US Federal Reserve. Investors Await Federal Reserve’s Monetary Policy Decision By 0259 GMT, spot gold prices retreated by 0.4 percent to $2,147.89 …

Read More »Weekly Recap: Surprising US Data Strengthens Case for Delaying Interest Rate Cuts

Last week, the market’s attention was squarely fixed on a slew of US economic indicators, aimed at deciphering clues regarding future interest rate trajectories and the Federal Reserve’s timeline for ending its monetary tightening stance and initiating quantitative easing. However, the latest US data, particularly the Consumer Price Index, US …

Read More »Global Stocks Pause Amid Inflation Concerns: Weekly Market Recap

Global stocks are poised to conclude the week with a subdued performance, following seven consecutive weeks of gains, as hotter-than-expected U.S. inflation data cast doubts on the timing and frequency of future interest rate cuts by the Federal Reserve. U.S. Inflation Data Dampens Rate Cut Expectations MSCI’s global equity index …

Read More »Dollar Poised for Weekly Gains Amid Central Bank Anticipation

The US dollar (USD) remained steady against the British pound (GBP) on Friday, as investors turned their attention to a series of highly anticipated central bank meetings scheduled for the upcoming week. Meanwhile, the Japanese yen (JPY) saw a slight decline amidst speculation surrounding potential shifts in monetary policy. Market …

Read More »European Shares Show Muted Activity Yet Head for Weekly Gains

European shares maintained a subdued stance on Friday, balancing strength in the telecommunications sector against a broader sell-off in global equities triggered by hotter-than-expected U.S. inflation figures, which dampened expectations of a June rate cut. Telecom Sector Strength Counters Equities Sell-off The pan-European STOXX 600 index remained flat, as of …

Read More »Oil Prices Poised to Finish Week Approximately 4% Higher

In a week marked by market fluctuations, oil prices showcased remarkable resilience, driven by optimistic forecasts from the International Energy Agency (IEA) and unexpected shifts in U.S. inventory levels. IEA’s Optimistic Forecast Spurs Confidence The week began with a notable uptick in market sentiment following the IEA’s revision of its …

Read More »CAD making notable gains 15/3/2024

An upward trend dominated the movements of the Canadian dollar during the previous trading session after it was able to penetrate the resistance level of the psychological barrier 1.3500, recording its highest level at 1.3543. From the technical analysis angle today, we are leaning toward positivity, relying on stability above …

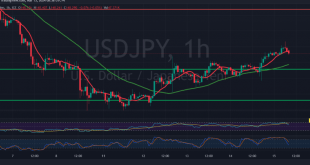

Read More »USD/JPY is trying positively 15/3/2024

japanese-yen

Read More »GBP breaks support 15/3/2024

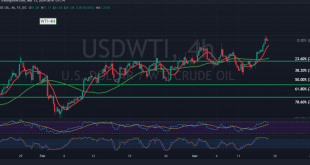

Oil, Crude, trading

Read More »Oil touches the targets 15/3/2024

Over the past two consecutive sessions, our focus has been on monitoring the price behavior of oil due to conflicting technical signals and trading confined within defined trend boundaries. As previously highlighted in our technical report, an upward trend commenced upon crossing above the resistance level of 78.70, representing the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations