U.S. stock index futures retreated on Wednesday, with megacap stocks feeling the heat from rising Treasury yields. This surge in yields fueled concerns about the timing of the Federal Reserve’s potential interest rate cuts. Tech giants like Apple, Meta, and Nvidia experienced declines in premarket trading, as the yield on …

Read More »Dollar Rises on Rate Cut Doubts, Surging Bond Yields

The U.S. dollar strengthened in early European trading on Wednesday, driven by growing expectations that the Federal Reserve will postpone interest rate cuts until later this year. This upward movement was also supported by rising U.S. Treasury yields, fueled by a lackluster debt auction. At 04:10 ET (08:10 GMT), the …

Read More »European Stocks Dip as Bond Yields Rise, Inflation Worries Weigh

European stock markets experienced a decline on Wednesday, driven by escalating bond yields that unnerved investors ahead of crucial inflation data releases. Fears of prolonged monetary tightening added to the market’s apprehension. Early in the trading session, the DAX index in Germany slipped 0.3%, while the CAC 40 in France …

Read More »Oil Prices Climb on Anticipation of OPEC+ Production Cuts and Peak Summer Demand

Oil prices experienced a boost in Asian trading on Wednesday, fueled by expectations that major producers will maintain existing output cuts at their upcoming meeting and the anticipated rise in fuel consumption during the summer season. Brent crude futures for July delivery saw a modest increase of 18 cents (0.2%), …

Read More »Dow Jones extends losses 29/5/2024

Oil, Crude, trading

Read More »Oil is making notable gains 29/5/2024

WTI Crude Oil Prices Set for Further Gains, but Caution Advised WTI crude oil futures prices are on a clear upward trajectory, having recently surpassed the targeted levels of 79.30 and 79.70 and approaching the key psychological level of 80.50. The commodity reached an intraday high of $80.28 per barrel, …

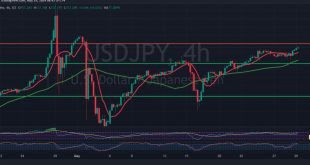

Read More »USD/JPY are recovering 29/5/2024

japanese-yen

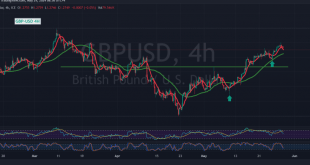

Read More »GBP/USD is testing support 29/5/2024

Oil, Crude, trading

Read More »Gold building on support 28/5/2024

Gold Prices Poised for Further Upside, Technical Analysis Suggests Gold prices have found solid footing at the 2340 support level, as highlighted in the previous technical report. This support, coinciding with the 23.60% Fibonacci retracement level on the 240-minute timeframe chart, successfully halted the recent downward trend and propelled prices …

Read More »Euro retests support 29/5/2024

The euro is experiencing a critical moment in its ongoing dance with the U.S. dollar. After a brief flirtation with the 1.0900 resistance level, the pair has retreated to 1.0845, leaving traders pondering its next move. A closer look at the technical landscape reveals a delicate balance between bullish and …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations