Oil, Crude, trading

Read More »WTI: Bullish Momentum Continues, Further Gains Anticipated 21/6/2024

WTI crude oil futures prices exhibited strong bullish momentum yesterday, successfully reaching our initial target of 81.50 and achieving a peak of $81.50 per barrel. Technical Outlook: The technical outlook remains bullish, with the 240-minute chart showing that simple moving averages (SMAs) are providing continuous support for the ongoing upward …

Read More »Gold: Bullish Momentum Emerges After Downward Trend 21/6/2024

Gold prices reversed their previous downward trend and rallied during yesterday’s trading session, surpassing the key resistance level of 2340 and reaching a high of $2365 per ounce. This price action indicates a potential shift in sentiment towards a bullish outlook. Technical Outlook: The technical analysis now suggests a continuation …

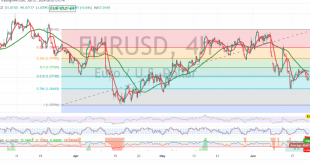

Read More »EUR/USD: Further Downside Expected Amid Negative Signals 21/6/2024

The EUR/USD pair continued its downward movement, as anticipated in our previous technical report, nearing our target of 1.0700 and reaching a low of 1.0715. Technical Outlook: On the 4-hour chart, the simple moving averages (SMAs) are maintaining their downward pressure, supporting the bearish price trend. The Stochastic oscillator has …

Read More »Bank of England Holds Interest Rates Steady Despite Easing Inflation

The Bank of England (BoE) maintained its benchmark interest rate at 5.25% on Thursday, despite a recent slowdown in inflation. This decision reflects the central bank’s cautious approach, as it continues to monitor underlying price pressures and robust wage growth. The Monetary Policy Committee (MPC) voted 7-2 to keep the …

Read More »Swiss National Bank Leads Global Policy Easing with Rate Cut, Signaling Confidence in Inflation Outlook

The Swiss National Bank (SNB) reduced interest rates for the second consecutive time on Thursday, highlighting its confidence in easing price pressures and solidifying its position at the forefront of the global policy easing cycle. The central bank’s decision to cut its policy rate by 25 basis points to 1.25% …

Read More »European Stocks Rise on Tech and Real Estate Gains, Swiss Market Boosted by Rate Cut

European shares experienced a positive trading session on Thursday, propelled by a surge in technology and real estate stocks. The pan-European STOXX 600 index rose 0.4% by mid-morning, with ASMI, a semiconductor equipment manufacturer, leading the charge in the tech sector after receiving an upgrade from Morgan Stanley. Switzerland’s benchmark …

Read More »Asian Markets Hold Steady, Awaiting U.S. Policy Signals and Key Central Bank Decisions

Asian stocks maintained their position near a two-year peak on Thursday, as traders eagerly awaited further guidance on U.S. monetary policy. The Bank of England (BoE), Swiss National Bank (SNB), and Norges Bank (Norway’s central bank) were all set to announce their policy decisions, further shaping the global interest rate …

Read More »Dow Jones: Bullish Momentum Continues, but Caution Advised 20/6/2024

Oil, Crude, trading

Read More »USD/CAD: Bullish Potential Amidst Positive Signals 20/6/2024

The USD/CAD pair has successfully held above the crucial 1.3690 support level, indicating a potential shift towards a bullish bias. Technical Outlook On the 4-hour chart, the Stochastic oscillator is showing positive crossover signals, suggesting a potential increase in upward momentum. Additionally, the Relative Strength Index (RSI) is attempting to …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations