European shares remained subdued on Friday as investors weighed the risks of an expanding conflict in the Middle East. However, strength in energy stocks helped prevent a further decline in the overall market. The pan-European STOXX 600 index held steady at 516.40 points as of 0709 GMT. Despite the resilience, …

Read More »Dollar Holds Near Six-Week High Ahead of U.S. Jobs Report, Yen Surges After Turbulent Week

The U.S. dollar hovered close to a six-week high on Friday, bolstered by safe-haven demand amid rising Middle East tensions and investor focus on the U.S. payrolls report, which could influence the future trajectory of U.S. interest rates. The dollar index, which tracks the greenback against six major currencies, stood …

Read More »Oil Prices Hold Steady Amid Middle East Tensions, Heading for Weekly Gains

Oil prices were relatively unchanged on Friday but remained on track for significant weekly gains as investors balanced the risks of potential supply disruptions due to escalating tensions in the Middle East against a well-supplied global oil market. As of 04:15 GMT, Brent crude futures slipped by 8 cents to …

Read More »U.S. Jobless Claims Rise Slightly, Remain Near Four-Month Low

The number of Americans filing for first-time unemployment benefits increased more than expected last week, though the figure remains close to the lowest level in four months, signaling continued strength in the U.S. labor market. Initial jobless claims for the week ending Sept. 28 rose to 225,000, up from a …

Read More »U.S. Stock Futures Fall as Middle East Tensions Escalate and Jobs Report Looms

U.S. stock futures continued to decline on Thursday, as rising tensions in the Middle East and the upcoming release of the official jobs report weighed on market sentiment. By 06:00 ET (10:00 GMT), Dow Futures had dropped by 125 points, or 0.3%, S&P 500 Futures were down 18 points, or …

Read More »U.S. Dollar Rises Amid Robust Jobs Data and Middle East Uncertainty

The U.S. dollar strengthened on Thursday, supported by robust employment data and geopolitical tensions in the Middle East. At 08:30 GMT, the Dollar Index, which measures the greenback against a basket of six major currencies, rose by 0.2%, reaching 101.597, close to its recent three-week high. Labor Market Strength Fuels …

Read More »European Stock Markets Mostly Fall Amid Middle East Conflict and Key Economic Data Awaited

European stock markets declined on Thursday as ongoing tensions in the Middle East dampened investor sentiment. Traders are also awaiting the release of key regional economic activity data, particularly services PMI reports, which could influence monetary policy expectations. By 07:05 GMT, Germany’s DAX index fell 0.4%, while France’s CAC 40 …

Read More »Oil Prices Climb Amid Middle East Conflict Despite Rising U.S. Crude Inventories

Oil prices surged on Thursday as escalating tensions in the Middle East raised concerns about potential disruptions to crude flows from the key exporting region. Despite a rise in U.S. crude inventories, the threat of a widening conflict overshadowed the stronger global supply outlook. By 06:15 GMT, Brent crude futures …

Read More »Dow Jones: Negativity persists 3/10/2024

Oil, Crude, trading

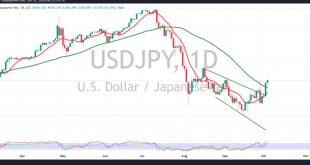

Read More »USD/JPY Extends Gains 3/10/2024

japanese-yen

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations