U.S. stock index futures edged lower early Wednesday, with Dow Jones Futures down 42 points (0.1%), S&P 500 Futures falling 7 points (0.1%), and Nasdaq 100 Futures slipping 40 points (0.2%). This follows Tuesday’s gains, driven by a surge in technology stocks, notably Nvidia, which rose 4%. Key Developments: Fed …

Read More »RBNZ Cuts Rates by 50 Basis Points Amid Inflation Target Achievement

New Zealand’s central bank, the Reserve Bank of New Zealand (RBNZ), reduced its cash rate by 50 basis points to 4.75% on Wednesday, aligning with market expectations. This marks the second consecutive rate cut, following a 25-basis-point reduction in August. Market Reactions The kiwi dollar dropped 0.9% to $0.6084, reaching …

Read More »European Stocks Trade Flat Amid Middle East Tensions, China Volatility

European stock markets traded in a subdued manner on Wednesday as investor confidence was hit by ongoing conflict in the Middle East and market volatility in China. DAX (Germany): flatCAC 40 (France): down 0.1%FTSE 100 (U.K.): up 0.4% Concerns over China and Middle East Conflict European stocks were impacted by …

Read More »Dow Jones faces negative pressure 9/10/2024

Oil, Crude, trading

Read More »USD/JPY Renews Rise Chances 9/10/2024

japanese-yen

Read More »Oil waiting to break support 9/10/2024

US crude oil futures experienced mixed, but mostly negative, trading after encountering strong resistance around the $78.40 level, which led to a pullback. From a technical perspective, we lean toward a bearish outlook, but with caution, as the Stochastic indicator on the 4-hour chart signals a loss of upward momentum. …

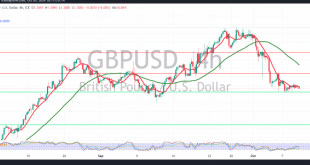

Read More »GBP awaits a signal 9/10/2024

Oil, Crude, trading

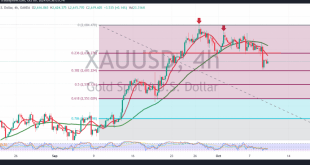

Read More »Gold may continue to achieve bearish targets 9/10/2024

Gold prices saw a sharp decline yesterday, aligning with the negative outlook in the previous report, which anticipated a break of the $2645 support level, reaching the target of $2605 per ounce. Today’s technical view suggests the potential for a continued corrective decline. The 240-minute chart shows a bearish alignment, …

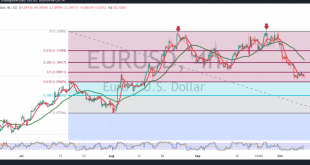

Read More »Euro holds steady below resistance 9/10/2024

The EUR/USD pair experienced negative trading in the previous session, diverging from the expected upward trend outlined in the last technical report, where we relied on the pair maintaining stability above the psychological support level of 1.1100. As previously indicated, breaking through 1.1100, and more importantly 1.1095, would halt the …

Read More »Gold Prices Fall as Traders Bet on Slower Fed Rate Cuts

Gold prices extended their decline in Asian trading on Wednesday, as growing expectations of slower rate cuts by the Federal Reserve weighed on the market. A stronger U.S. dollar, supported by rising Treasury yields, added pressure on metals. Spot gold slipped 0.2% to $2,615.90 per ounce, while December gold futures …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations